Did you know that only 32% of Americans regularly maintain a household budget? This abysmal statistic serves as an important reminder that the best practices of budgeting are not as commonsense as they may seem and it’s not enough to simply know how to budget – you have to put this information into practice if you want to see real change in your financial situation.

Of course, budgeting isn’t exactly the most fun thing to do, especially when you could be spending that precious little free time on more enjoyable hobbies like traveling or hitting the gym. If you’ve struggled with budgeting in the past or you only recently decided it’s time to start following a budget, how can you get up to speed without getting stuck on the more boring or frustrating aspects of budgeting?

The notion that budgeting doesn’t have to be confusing and chaotic is the founding principle behind the Goodbudget app, which describes itself as tool that encourages folks to “budget with a why.” In other words, Goodbudget doesn’t just teach you how to budget – it offers compelling reasons and advice for why you should have a budget (and stick to it!).

If you’ve been looking for an easy-to-use personal finance app designed for people who are either new to budgeting or dread budgeting, then here are a few reasons why Goodbudget is ideal for reorganizing your finances and motivating yourself to stick to a budget from now on.

Innovative Budgeting Tool

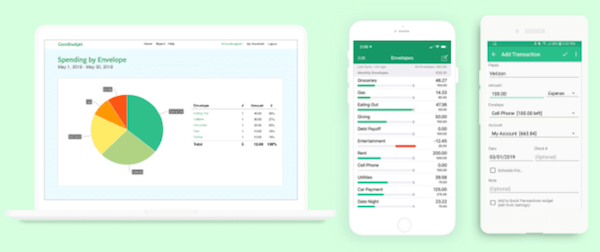

By now, you might have heard about the envelope method of budgeting, which relies on the practice of allocating cash into categorized envelopes for each aspect of your budget to be effective. However, in our digitalized society, it can be difficult to rely exclusively (or even partially) on cash as a budgeting system, which is why the Goodbudget app is so handy: it’s modeled after the envelope system but you manage everything through a digital app.

This way, you’re able to allocate portions of your monthly income into fixed spending categories (e.g., rent/mortgage payments, groceries, utilities, loan payments, gas, etc.) and determine how much money you have leftover to either divert into a savings account or pay off more debt.

The reason why the envelope method is so successful (and Goodbudget’s approach, by proxy) is because you’re effectively limiting yourself to spending only what’s available in the envelope. If you have $200 allocated for entertainment and dining expenses but you run out midway through the month, then you’ll have to wait until next month (when you refill the envelope with its next infusion of cash) to resume activities like movie nights and brunch dates with friends.

This method certainly requires a lot of self-control to avoid stealing cash from other envelopes to fund something you prematurely ran out of money for, but Goodbudget makes it significantly easier to stick with it and make it your new financial management habit once you get used to it.

Track Balances Across Multiple Accounts

Goodbudget is useful for so much more than just greater personal accountability with the envelope budgeting method. Whereas physically managing cash can get confusing pretty quickly – what happens if you lose track of an envelope one month? – Goodbudget makes the entire process a breeze by letting you track balances on multiple accounts (checking/savings accounts, credit cards, loans, etc.).

You can also access Goodbudget on multiple platforms (computer, phone, tablet) and add a spouse or other family member to your account to ensure everyone is on the same page when it comes to managing your collective budget. This makes Goodbudget an ideal financial management strategy for couples with shared expenses, families with dependents and even household roommates who combine expenses like rent, utilities and/or food.

How Much Does Goodbudget Cost?

Goodbudget is great because it offers both free and paid versions of its software. The paid version costs $50/year or $6/month and comes with additional features and bonuses, such as:

- Unlimited regular envelopes

- Unlimited more envelopes

- Unlimited accounts

- 5 device capability

- 7 years of budgeting history storage & record-keeping

- Email support

By comparison, the free version of Goodbudget limits you to 10 regular envelopes, 10 more envelopes, 1 account, 2 device capability, 1 year of budgeting history, and community-based support.

Is Goodbudget Right for Me?

If you’re looking for an affordable, effective, no-nonsense method for budgeting and saving up for large expenses, then you can’t go wrong with Goodbudget. It doesn’t bog users down with complicated features and pointless frills like some other personal finance apps out there – it simply offers a clear picture of your customized budget, which you can adjust whenever and access wherever.

Stop waiting for the “perfect” time to start budgeting to arrive – Goodbudget is an excellent tool for anyone who needs a little more organization and motivation in their financial lives, so take advantage of this opportunity now to experience the benefits of following a budget later.