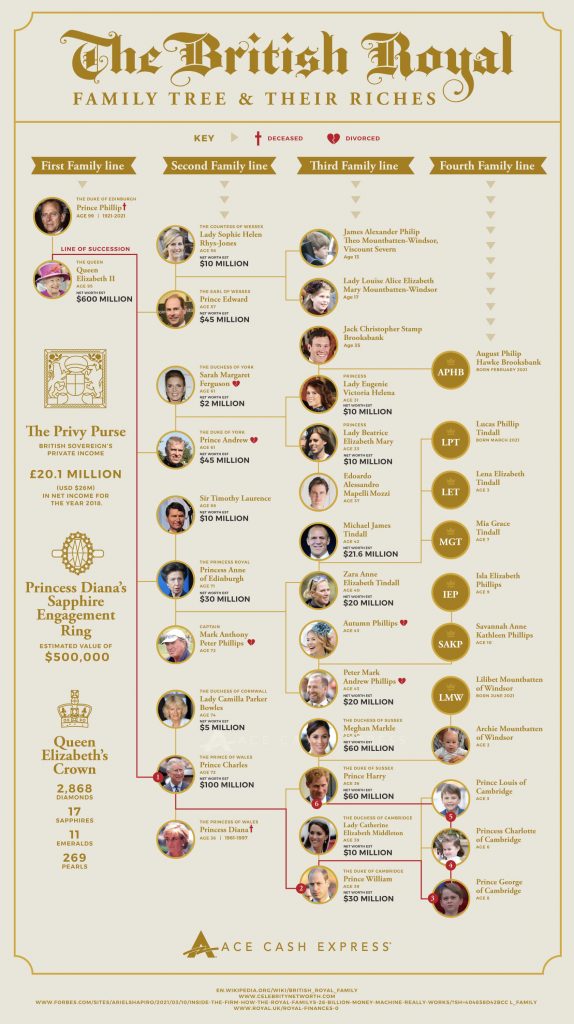

Queen Elizabeth II has reigned as queen ever since, nearly 70 years. In her lifetime, she has achieved it all — power, prestige, and perhaps most significantly, wealth. But, how much is the royal family worth?

According to Forbes, the British royal family is now worth over $28 billion; that’s more money than the entire GDP of Iceland. The queen herself is estimated to have a net worth of over $600 million, most of which comes from her investments, jewels, and two castles.

The queen may be sitting comfortably, but how about the other members of the royal family? Sit back, pour yourself a cup of tea, and check out our latest infographic to find out the net worth of your favorite royals. You may be surprised to see who’s at the top.

What Is Net Worth?

Net worth is defined as the net value of assets owned minus the net amount of liabilities owed. It is commonly used to measure an individual’s net economic position by including all tangible and intangible assets in a singular figure.

The net worth of a business is referred to as its book value, which is based on the fair market value of all assets less any outstanding debt or other outside obligations. Business owners with a positive net worth are often rewarded with loans from financial institutions because they can provide collateral for their loans in the form of the company itself. A negative net worth makes it difficult for entrepreneurs to secure financing from most traditional sources.

Why Net Worth Is Important

By keeping track of your net worth you will be able to monitor your progress towards achieving personal financial security or wealth. This is done by using net worth to track your assets and liabilities over time, which will provide you with an accurate picture of your net worth.

Net Worth Is Effectively = net income + net savings & investing – net debt

Net worth can also give you an idea of how much net income and net savings are leftover after monthly bills and debt payments that month. This provides a more accurate view than simply looking at salary or wages that month, which doesn’t include any debt obligations such as loans, credit cards, etc. It also doesn’t take into account any other cash flow such as cash on hand, dividends from investments like stocks or mutual funds, rental property income/expenses, etc.

By adding up what’s left after paying all monthly debts and bills (ie: net income) we’re able to see just how much net savings we have left for the month which will go towards saving and net worth increase, personal loans, applying for loans such as mortgages, or to spend on net debt such as credit cards and other miscellaneous monthly bills.

The following infographic was originally published on the ACE Cash Express blog. It has been reprinted with permission.