Note – This blog post may contain affiliate links. While all opinions are my own, and I’m a long-time user and proponent of M1 Finance, I do receive a small compensation if you choose to sign up through the links in this article.

Investing can strike fear in the hearts of far too many. But, it doesn’t have to!

Be sure to check out Money Q&A’s full review of M1 Finance!

Behind the Scenes Interview with Brian Barnes – Founder of M1 Finance

Here are 12 great questions that Hank Coleman and Lacey Langford asked Brian Barnes, the founder of M1 Finance, on the MilMoney Movement Podcast. The topics were wide-ranging from investing through the M1 Finance platform, investing using margin, M1 Finance’s incredible growth, and even our favorite investing metrics that we use to find undervalued stocks.

Note – Our questions for Brian are in black, bold type. And, his answers appear below them.

So, here is the behind the scenes questions and answers from Brian Barnes, the founder of M1 Finance…

Tell us a little bit about M1 Finance. What is it? What it’s about?

So, instead of placing trades, you’re building a portfolio on M1 Finance. So, instead of saying I want x number of shares of this stock, you’re saying I want 5% of my money to go into this stock. Once you’ve built that portfolio, you’re just adding or withdrawing money. All the money automatically and intelligently flows into that portfolio.

We do a lot of cool things like use fractional shares. So, 100% of your money goes to work. We dynamically are rebalancing the portfolio as money’s coming in and out, and we’re doing it all for free. So, generally speaking, it’s just a simpler, more convenient and cost-effective way to invest your money.

How does M1 Finance earn income?

We get the question a lot. In some sense, M1 Finance is a finance platform which is not all that dissimilar from checking accounts, which tend to be free and credit cards, which tend to be free. So, there’s a big precedent in the financial service world of offering the product for free and monetizing through other means.

And, it’s actually something that brokerages do as well. If you look at the big ones, Ameritrade, e-trade, they typically only make about 10 to 30% of their money from the explicit commissions that they charge customers. And, the other 70% to 90% is other revenue streams that exist in the brokerage space.

And, so we’re building our entire business at M1 Finance on the 70% to 90%. Anytime cash is held on the platform, we can monetize that primarily by lending to banks. We can lend out the securities that people own on the platform. There’s a big marketplace for lending securities to facilitate short selling. And, we can lend to those short sellers too and earn interest on the securities that we lend out.

We get paid to transact on various exchanges. This is called payment for order flow. The user actually gets a price improvement, and we get a share of that.

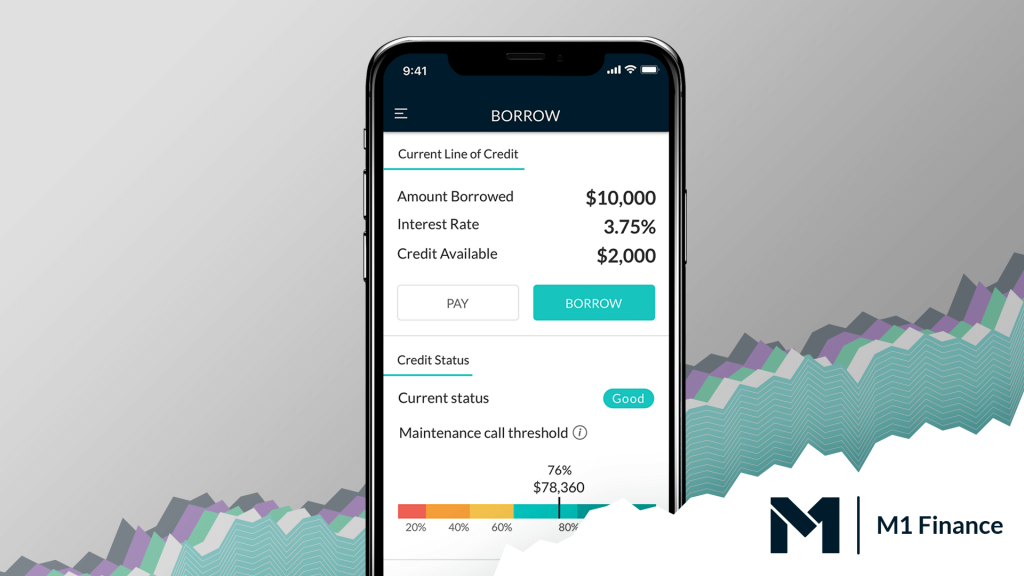

So, those are three big revenue streams. And, then a product that we just released is M1 Borrow. It allows you to borrow money using your portfolio as collateral, and you get access to a super low-interest rate loan.

It is incredibly flexible terms that you can draw down whenever and payback whenever. It’s sort of yours to control this line of credit as you see fit. And, we do make money on the interest that we charge on the funds that we lend out.

Is there a minimum balance for M1 Borrow? How does that work?

Currently, it’s $10,000, and then we lend out up to 35% of your portfolio value. We launched that product about three weeks ago, and we’ve had a lot of interest and significant uptake in a short amount of time. And, so the fact that it’s above $10,000 does cut out some accounts.

We are going to bring that threshold down over time, but we’re starting with a more reasonable sum to just get comfortable with the product. Currently, M1 Borrow is about 5% of our total assets under management that are extended as a loan, which is a pretty significant uptake in a short amount of time.

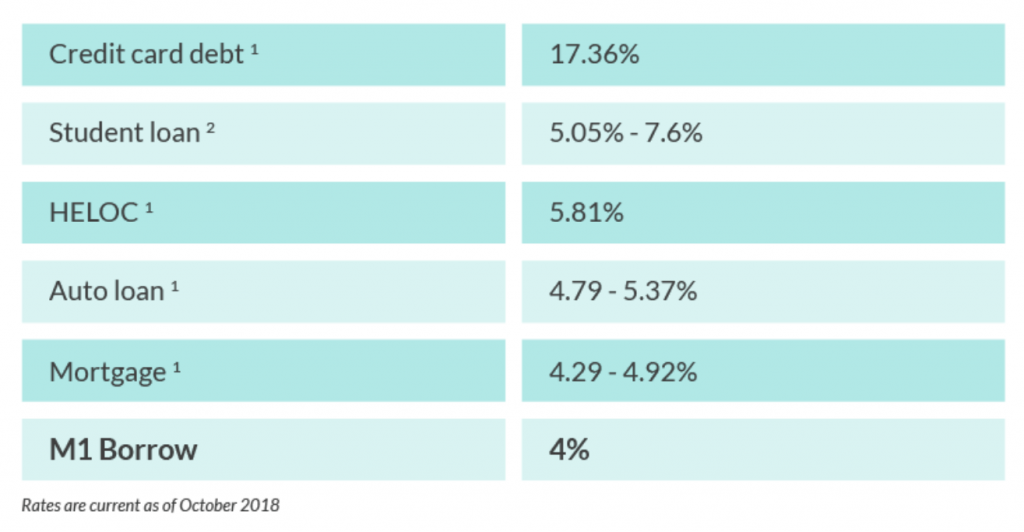

We’re very happy with the release of M1 Borrow, and it’s something that the current users are primarily using it to consolidate loans that they’ve held elsewhere. So, they may have $100,000 portfolio and $22,000 in an auto loan at 6.5%. They can immediately drop the interest rate to 4% through M1 Borrow. So, it’s an immediate way to save a $1,000 a year in interest.

We basically use the M1 Finance platform for investing. It’s a best in class investing platform that lets you do things that you can’t do anywhere else simply by investing for free. But, it also opens up this line of credit.

Whether you use it or not, it’s there. It’s for the taking if you want it. And, it provides a lot more flexibility than you’d get if you had a HELOC or auto loan. Instead of a personal loan where you’re filling out paperwork and going through credit approval process and having rigid terms on it, you now have this line of credit that exists. Use it if you want. It’s an option. We like the optionality that it provides.

Now, M1 users with just $10,000 invested in a taxable brokerage account can instantly access a flexible line of credit at one of the lowest rates on the market. With immediate approval and only 4% APR, it’s the perfect alternative to an auto loan, HELOC, credit card, or even margin loan. You can even pay it back on your schedule.

Tell us about the pies on M1 Finance. How does that work?

If you log into a typical brokerage account, it’s just tables and rows of numbers. And, it’s impossible to discern anything that’s happening. So, we decided to make the entire investment process visual and graphical so that you can get more of what’s happening in your account at a glance.

Building your portfolio is all around building pie charts, and we call them pies as a result. If you think of the pie chart, you can slice it into slices, and you’re basically specifying what share of your money you want to go into various investments.

So, you can say I want 10% of my money to go into Amazon, or I want 5% of my money to go into Apple. And, you’re just specifying what percent of your money goes into various securities and building up that 100% pie. The nice thing is that it allows you to really organize and visualize what’s happening.

And, so with the organization portion, I said you can have 10% in Amazon. But, you can also say I want 10% in technology stocks, and that can become its own pie that you can slice and dice. And, it’s a really intuitive way to organize your portfolio.

The pies are one of those things that you almost have to use to fully understand. The shape of the pie changes based on how your portfolio is performing according to the targets that you set up as well.

What are expert pies?

We have a big catalog of what we call expert pies. And these are pies put together either by professionals on the M1 Finance staff or external providers. Some of the pies we use were put together by Nuveen, a large investment manager in the Chicago land area.

We have a huge catalog of expert pies for any goal that you’re going for. We have expert created portfolios, and you can grab those. You can make it your entire portfolio. You could make it a portion of your portfolio. Even if you’re not super competent in building your entire portfolio from scratch or customizing a completely, we have expert options that you can grab.

Do a lot of customers use prebuilt pies or invest on their own?

Many customers are using an expert Pie for a portion of their portfolio, but they’re also customizing a portion. The customization is really what makes M1 Finance unique. It allows personalization in ownership over what stocks and funds you actually own.

In terms of the numbers, I would say roughly speaking about a quarter of our users use an M1 prebuilt pie and only an M1 pie. And, that’s their entire portfolio.

About half of our users use a combination of things that we’ve built and things that they create. And, then a quarter of M1 Finance users sort of go at it alone, are fully customized and don’t use any of our pre-made selections.

Are engagement rates higher using visualization with these pie charts?

We think engagement is absolutely critical to the investment process. You can’t succeed at anything by not caring about it.

And, the added visualization makes it understandable and relatable. We can see what’s going on at a glance rather than trying to discern across 15 arbitrary numbers that are thrown at you.

The visualization is a helpful thing, and it gets people more comfortable and confident with their investments and then picking their own investments. People are often a little hesitant to go out and pick their own investments. You’re risking your dollars, your hard earned money, your life savings.

The nice thing about M1 Finance is that you can carve out a slice and can have it be a small slice of your portfolio to allocate to your own decisions. So, you can say that I want 95% of my money prudently managed for me in an expert portfolio, but 5% I want to be in my stock picks. And, I’m going to have ownership and selection in over there.

It’s not going to make or break you. It’s going to just add engagement. And, what we see is anytime those people log in is that they actually don’t care about the 95%. They go to that 5%.

I use the analogy, it’s sort of like anybody plays fantasy football. You care about your team normally, but if you play fantasy football and you have a player on another team, you watch that game.

And it’s the same thing when you have a stock portfolio where you’ve actually selected an investment of your choosing. You start following it more, you start caring about it more. You read the press. You start learning about what makes stocks go up, what makes a business solid and increases their earnings. And, so the engagement definitely increases with the personalization.

Do we need to dabble in individual stocks? Is that what we’re missing?

I think it’s a massive, huge part of it. I think the difficult thing in investing is it people sort of position it as you do nothing or you do the absolute pinnacle of amazing and there’s no spectrum in between. And, I don’t think that is accurate nor sets you up for behaving in the correct manner.

And, so with investing, it’s not whether you get things perfect. It’s whether you get the big things right. It’s whether if you have investable assets. Are 80% of them invested or are 10% of them invested? If you’re saving money, are you saving 1% of your salary or 15% of your salary?

So, if you get the big thing right and then add something that actually makes you systematically save, makes you contribute to your portfolio on a regular basis, you’re going to be successful. And, that’s really only done through actual engagement, actually enjoying the process. That’s how you set yourself up for success rather than dedicating a life to trying to be a hedge fund manager with your stock picks.

How can people increase their investing fluency/knowledge?

The nice thing is that in the digital world there’s just so much out there for free. And whether that YouTube videos, whether that’s podcasts, whether that’s blogs to read, whether that’s just online sites to go to consume information. There’s so much out there that is trying to bolster up the intelligence.

I think the financial service world has created their own vocabulary to make it off-limits to justify their high fees. And, I think half of building up financial understanding is just breaking down the language barrier that exists in the financial markets. A great tool for that Investopedia has a fantastic dictionary of the investing terms, and changing an investing term into a vocabulary term that you use in your everyday life is a huge boon for your general financial literacy.

And, then in terms of the building up confidence, I think there are two things to do. With a solution like M1 Finance, like we talked about, you can start small. So, you can sort of say I’m going to allocate 2% of my money to the learning and experiment there while the other 98% is going to just be prudently managed and you can get a portfolio for free. So that’s a nice benefit of how the world currently works.

The other thing I think that we sort of neglect is that it’s better to focus on the process when learning to invest than the actual outcome. And, so in some sense, the good financial habit is investing 100 bucks a week. It’s not trying to outperform the market. So, if you’re automating these habits and processes so long as you’re doing what’s required to have good financial habits, you should chalk that up as a win rather than looking at your portfolio on a day to day basis.

It’s the big thing that matter. Is 80% of your money invested or is 20? Or, when you get to retirement will you have saved for the last 40 years or the last 20 years? That’s going to be a huge difference. Time’s on your side.

Assets generally appreciate. When you invest in a company, you have all of their employees working super hard to try to make it more valuable. That’s a fantastic proposition. That’s what ownership entails. And, so getting started early, setting up habits and processes and automating it as much as possible is definitely 90% of the effort in investing.

I used the analogy internally in the company. It’s like exercising. There’s an entire spectrum of exercising that you can possibly do. You can be the elite of the elite. You can be a professional athlete. Or, you can try and hit the gym as much as your schedule allows. But, the absolute worst thing you can do is be a couch potato do nothing. And, I think the same as in your finances.

To be so afraid that you do nothing is the riskiest proposition at all. And, you know, in terms of exercising, you don’t need to strive to be the professional athlete. You don’t need to strive to be the professional hedge fund manager either. You need to try to be healthy.

And, being healthy involves systematically investing, investing according to your risk tolerance and having engagement, and adding to your fluency (your investing vocabulary). And, so it’s more about smart, prudent habits rather than perfect, ideal habits.

What are some common mistakes people make when investing?

There’s not a single investor out there who would say that diversification is bad. There are just some things that you can’t protect against. If you invest in a single company with an unbelievable product, unbelievable CEO, even that can go bad. The CEO could get struck by lightning the next day, and that’s something that you can’t predict or protect against.

And, so having diversification and spreading your money across different investments is a financially sounded and prudent thing to do. The other thing is the time horizon. Tomorrow, the market will be up or down a percent. Is it worth 1% more or less? Nobody knows. Things move up and down, and that’s how the world goes.

And, really what you’re doing with managing your financial life is trying to set you up for a good position in five, 10, 15, 20 years down the road. And, so what happens today versus next Monday? The grand scheme of things it’s not as important as setting up your recurring deposits, making use of tax-advantaged accounts. If you get the fundamentals right, you’re in the top core percentile of investors out there.

What are the different types of accounts that are available on M1 Finance?

The standard account is probably your taxable brokerage account. That’s more or less like a bank account but for holding and buying securities rather than checks and deposits. You can have that be an individual account. You can have that be a joint account if you have a spouse or significant other. Any legal entity such as a trust, an LLC, a corporation can create these taxable brokerage accounts. And, so that’s in the taxable realm.

We also have tax-advantaged accounts. The government has set up these types of accounts that are trying to encourage saving for retirement. And, in exchange for that, they basically allow you to grow your investments without incurring taxes on the growth. And, so this is your traditional IRA and your Roth IRA. If you’re a business owner, you can open up a SEP IRA.

And, so these types of accounts are all available on the M1 Finance platform, and you should make use of them to the extent that they’re able to. I always joke that the government puts limits on these things for a reason. It’s almost like too good of a deal.

If they didn’t have limits on it, everyone would use it considerably more. And, it’s one of the best deals in investing that you’re going to have. Opening up an IRA and in trying to max it out every year is a huge boon.

How is the growth of M1 Finance? Assets under management, new account signups?

Growth is great and accelerating, which is always fun to see. We’re signing up 500 to 600 new brokerage accounts per day and adding a couple million dollars a day in new funds. Now, we’re currently managing a few hundred million dollars in assets under managment (AUM). We’re very excited and definitely have more to come.

MilMoney Movement Podcast – Episode 11 with Brian Barnes

Be sure to listen to the entire podcast to hear more from Brian Barnes and about M1 Finance.

What makes their investing platform unique is that they make investing simpler, more convenient and cost-effective by helping you build an investment portfolio instead of trading stocks. And they do it all for free. In Episode 11 of the Military Money Movement Podcast, Lacey Langford and Hank Coleman talk to Brian Barnes, the founder of the free automated investing platform, M1 Finance.