Money management has never been easier, thanks to the proliferation of AI-driven, hyper-efficient banking and investment platforms over the past few years. Whereas paying someone back used to take a few days and/or a physical meet-up, you can now instantly send money to anyone in the world.

Unfortunately, many traditional banks have failed to keep up with consumers’ changing money management preferences and continue to charge for basic services like ATM withdrawals, account management, and money transfers. If you’re looking for a highly efficient, innovative and consumer-friendly banking option, then ditching your big bank for N26 could be your best financial move all year.

N26 Review

N26 was first launched in 2013 in Europe and quickly grew to more than 2.3 million customers across 24 European countries. Six years later, N26 entered the U.S. market, ready to disrupt traditional banking and offer American consumers more personalized, hassle-free banking experiences designed for modern, mobile consumers.

If you’re tired of dealing with hidden (or exorbitant) fees, lousy customer service and mediocre amenities from your current bank, then here’s why you should consider switching to N26.

Innovative Mobile Banking Experience

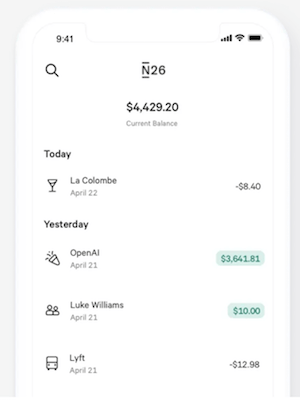

There’s a reason why N26 has grown in popularity (4.5 million customers across 45 different markets) so quickly: because they offer one of the best user experiences the banking industry has to offer. Available through both the Google Play and Apple app stores, N26 has over 65,000 five-star reviews from users thanks to its ease-of-use, nifty features, clean design, and transparent money management processes.

Some of the best features N26 offers include MoneyBeam (send/receive money from other N26 users), Spaces (savings goals allocations), fee-free ATM withdrawals, early direct deposits, and many more. You can also track your daily spending, receive instant transaction notifications (for maximum security), and lock or unlock your card instantly from the app.

Personalized Financial Planning

N26’s “Spaces” feature lets you easily set-up, organize and plan for future savings goals. All you need to do is create a new sub-account then drag and drop funds into accounts based on your savings strategy and prioritized goals. Whether you’re saving money for an upcoming family vacation or a down payment on a home, N26 lets you easily monitor your savings goals without needing an external money management app or spreadsheet to keep you organized.

The personalized financial planning feature is particularly useful for separating your savings goals, tracking your progress and effortlessly moving money around whenever you want or need to. The simplicity of the app makes it easier than ever for consumers to strive towards their savings goals without frustrating app meltdowns, confusing app features or costly account management services impeding their progress.

Free ATM Withdrawals

Many banks charge as much as $3-5+ for out-of-network ATM withdrawals, but with N26, you’ll get access to fee-free ATM withdrawals at more than 55,000 Allpoint® locations in the U.S., Mexico, Canada, Australia, and the U.K.

Fee-free ATM withdrawals also include retail locations like Target, Kroger and CVS; even if you find yourself out-of-network, N26 gives its customers 2 free ATM withdrawals per month from any network, which means you will rarely – if ever – need to pay a fee to access your cash ever again.

Even if you’re traveling abroad and need to access cash, N26 banking is ideal for foreign travel thanks to its mobility and free ATM withdrawal allowances.

Discounted Subscriptions

As an added bonus for N26 users, you can access exclusive discounts on subscriptions to popular apps with your N26 card. N26 partners offering these discounts (10%) include:

- Luminary (podcasting app)

- Blinkist (reading app)

- Aaptiv (fitness/health app)

- TIDAY (streaming music app)

Should You Switch to N26?

Until major banks get on board with more consumer-friendly account management practices, mobile banking companies like N26 will continue to dominate the fintech banking industry. It takes just 5 minutes to set up a new account with N26 and there are no fees involved: no account maintenance fees, no minimum account balance fees, and no insufficient funds fees.

N26 calls itself a fast, flexible and transparent alternative to traditional banks, and they’re not wrong. The app is highly secure – on par with other major banks’ security mechanisms – and you get complete control over your accounts without nuisances like maximum transfer limits, sub-account restrictions, minimum account balance requirements and out-of-network limitations holding you back.

If you’ve been waiting for the “right” moment to make the switch to a more consumer-friendly bank, then now is the best time to join N26 and ditch your old bank’s high fees, vague account guidelines and limited app functionality for good.