If you’re not thrilled with your current credit score or you’re struggling to get access to credit at all due to a lack of credit history, then, fortunately, there are some options available for people seem to be stuck between a rock and a hard place like you are.

After all, having a bad credit score can affect seemingly everything – rental applications, access to low-interest financing options, and even your love life – so getting your credit score back in shape should be a major priority.

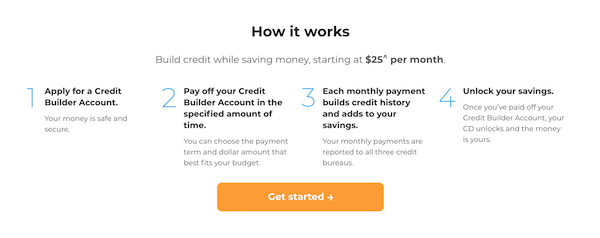

One innovative option for folks with no/bad credit is Self Lender, which lets you make regular payments on a fixed amount for 12-24 months and cash out later. Although there is a nominal administrative fee ($9-15) and some interest involved, you’ll likely pay significantly less through Self Lender than you would on a traditional loan with a bank or other online lending company.

Best of all, your on-time payments get reported to the 3 major bureaus, which will increase your credit score over time! Here’s what you need to know before signing up for Self Lender.

What’s a Credit Builder Account?

Self Lender is an incredibly unique fintech platform in that it offers a relatively low-interest, minimal hassle way for people with no or bad credit to increase their credit score without a traditional loan. Whereas a personal loan might come with high interest rates for someone with no credit history or a poor credit score (assuming they even qualify for a personal loan), Self Lender simplifies the process by giving you access to a credit-building opportunity that won’t break the bank.

Specifically, Self Lender puts money into an FDIC-insured Certificate of Deposit listed in your name and lets you make payments in $25, $48, $89 or $150 monthly increments over the course of 12 or 24 months (depends on the type of Credit Builder account you choose).

Improve Credit Score

It may seem strange to make payments on a loan you don’t get upfront, but Self Lender makes this worthwhile by reporting your timely payments to the three major credit bureaus every month. A whopping 35% of your FICO credit score is based on your history of making on-time payments to your creditors and lenders, so being able to demonstrate a long track record of responsible financial management is key for raising your credit score.

Since you’re locked into a CD for 12 months (or possibly 24 months), then you have no choice but to hold yourself accountable for meeting payment deadlines on time and in full. This makes Self Lender an ideal channel for people with impulsive spending or poor money management habits to get back on track to financial stability.

Free Credit Monitoring

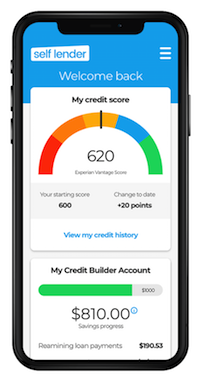

How often do you check your credit report? If your response is “never” or “rarely” or “I can’t remember,” then that’s all about to change with Self Lender, which offers a free credit monitoring service to its users.

After all, one of the best aspects of Self Lender’s service is that it’s designed to help you boost your credit score – it makes sense they’d want you to be able to track your credit history over the course of your Credit Builder account.

How Much Does Self Lender Cost?

Getting started on Self Lender can cost as little as $9 (one-time, nonrefundable administrative fee). This amount represents the cost of a Credit Builder plan in which you pay $25/month for 24 consecutive months.

The $48/month Credit Builder plan lasts for 12 months and involves a $15 administrative fee, while the two highest plans of $89/month and $150/month last 12 months and involve a $12 administrative fee.

The interest rates and APRs vary from plan to plan (10.34% to 13.16% for interest and 12.03% to 15.65% for APR), as do the finance charges ($46-112, depending on the plan). Fortunately, the funds you invest in Self Lender are put in an interest-accruing Certificate of Deposit, which means you’ll earn some money back on the base amount you put in.

For example (from Self Lender itself), you’ll pay $609 total for the $25/month for 24 months Credit Builder plan and receive $525 plus interest at the end of the loan.

Should I Sign Up for Self Lender?

If you’ve been looking for an easy-to-use and relatively low-cost strategy for building your credit history, then Self Lender is the way to go. The interest rates it charges for different Credit Builder accounts are predominantly lower than the interest you’d be paying on a personal loan (which are also commonly used for building credit), and you can earn interest on your payments by cashing out a CD by the end of your term.

Whether you have no credit history or you have a history of missed payments and maxed out cards, Self Lender is an optimal solution for anyone who wants to get back to the Good/Excellent level of credit scores without the hassle and cost of traditional loans.