Student Loan Hero was founded by a man who struggled, yet successfully paid off over $100,000 in student loans. Given the shocking statistics surrounding student loans, he wanted to help others pay off their loans as efficiently as possible, which led him to create the free Student Loan Hero platform.

What Is Student Loan Hero?

Student Loan Hero is a fantastic resource to start if you’re looking for ways to pay off student loan debt faster.

Here are some key features you won’t want to miss about Student Loan Hero:

Student Loan Hero’s Features

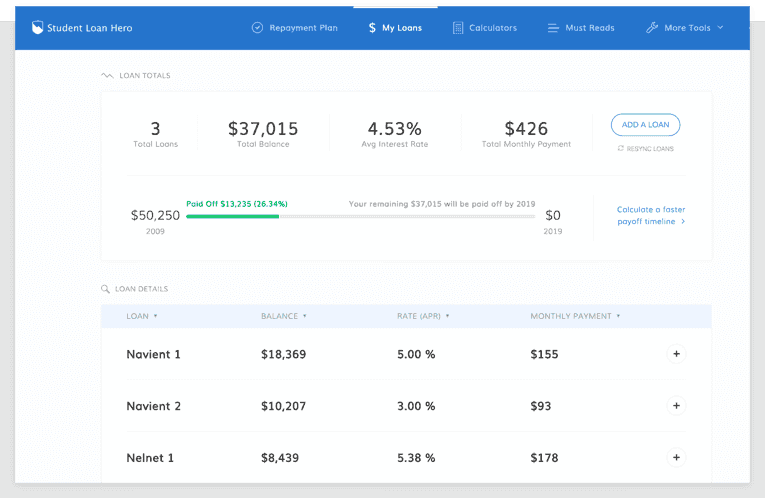

Student Loan Hero’s dashboard was clearly designed for ease-of-use, with a simple navigation toolbar at the top and useful visuals to help you chart your loan repayment progress. Student Loan Hero’s purpose is pretty straightforward: to help other people repay their student loans faster by offering a vast database of information (on nearly every student loan-related topic imaginable). And, the site also links to useful websites to help folks lower their debt loads or learn whether their loans are eligible for one of the many available loan forgiveness programs.

Student Loan Hero even covers topics like student loan default to help anyone bogged down with educational debt get back on their feet without serious detriment to their personal financial situation. No matter where you’re at in your student loan repayment process – just took out loans, trapped in a seemingly endless cycle of debt, or on the verge of finally paying off your balances and need some more help – Student Loan Hero is a great resource for helping people with their student loans, free-of-charge.

Personalized Repayment Options

If you want to reduce your student loan interest payments, then consolidating multiple loans into one loan with a lower interest rate could be an ideal choice. Student Loan Hero lists several low-interest refinancing options from private lenders, with rates ranging from 2.10% to 9.85%, depending on your financial history and credit background.

Some of these loans may include a soft credit check, while others might not perform a credit check at all. Student Loan Hero’s nifty comparison chart lets you know which private lenders require these checks in addition to other useful refinancing information like the loan terms and links to private lenders’ websites.

To help you decide whether refinancing your loans is right for you, Student Loan Hero offers an extensive cheat sheet for student loan refinancing and consolidation. The guide was designed with struggling student loan borrowers in mind and includes almost everything you need to know about refinancing student loans to get the lowest rate possible and lower the amount of interest you’ll have to pay on your education debts over the long-run.

You should also check out Student Loan Hero’s section on the best banks to refinance and consolidate loans. The comparison charts contain useful information on different companies’ eligibility requirements, minimum/maximum lending amounts, unemployment protections, discharge of loans in case of death, fee information, the average time it takes to apply for refinancing loans, and more. Researching this information on your own would take several hours, but Student Loan Hero makes it easier for folks to make a decision by offering all of these details in an organized chart.

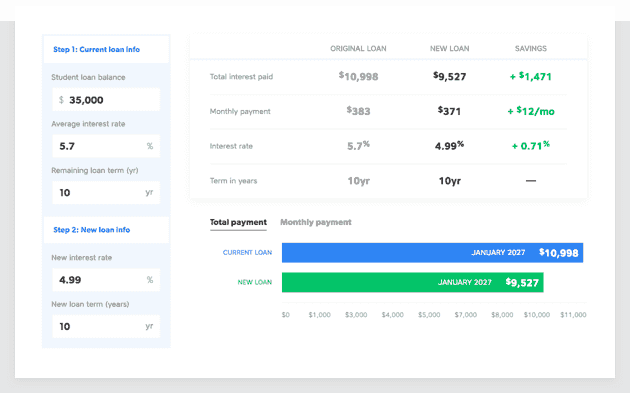

Student Loan Hero Calculator

Student Loan Hero has fourteen different student loan calculators to help people manage their loans. Whether you’re looking for a debt-to-income calculator, lump-sum extra payment calculator, monthly payment calculator, refinancing calculator, or more, Student Loan Hero seems to have a calculator for any situation you might encounter while taking out, refinancing, and paying off student loans.

The calculators are a particularly useful feature for anyone who’s not exactly a math whiz and doesn’t want to miscalculate student loan repayments using a regular calculator. So, don’t leave these valuable tools out of your financial toolbox.

Sign Up for Student Loan Hero

If you’re ready to make the leap and sign up for Student Loan Hero, then all you need is an email address, Google, or Facebook account to get started. Once you sign up, your first task is syncing your loans with your account, which you can do through the National Student Loan Data System or by selecting your student loan servicer from a drop-down menu on the page.

All you need is your Federal Student Aid ID username and password to proceed from this point. And, once your loans are synced up, you’ll be able to track your progress from Student Loan Hero’s helpful dashboard.

Don’t let the gloom and doom news about millions of people drowning in student loan debt faze you. Student Loan Hero offers a unique, highly informative platform for users to navigate their loans and develop the most effective repayment strategies, free-of-charge.

Sign up today for Student Loan Hero to see how they can help you refinance, consolidate, and repay your student loans, whether you owe $1,000 or $100,000.