When it comes to loans and deposits, there are only two types of interests applied; simple and compound. The type of interest applied depends on the interest rate offered by the lender in most cases. Calculating interest is one of the most confusing tasks, but only in the case of compound interest.

Simple interest is quite straightforward and easy to calculate. Compound interest is where individuals tend to get confused, which is why an online compound interest calculator comes in handy. But before you go ahead and start calculating, it is best that you first understand what it is, why businesses use it, and how it is calculated. So let us go ahead and answer all these questions in detail.

What Is Compound Interest?

Compound interest is the type of interest in which the interest for the periods is added to the principal sum when calculating the interest for the next period. In simple terms, the principal amount on the basis of which the interest is calculated changes at the end of every period. In mathematical terms, the new principal amount is P + I, where I represent the interest of the prior period.

You can also say that it is interest calculated on interest. This means that as compared to simple interest, the amount of interest accumulated at the end of the period is always higher, which makes it a great approach for lenders but a poor one for the borrowers. So when getting a loan or investing in a savings account, make sure to check which type of interest the institute or the lender is offering.

Uses of Compound Interest in Business

In business, either simple or compound interest is used by the business owners. But in most cases, the lenders often tend to opt for compound interest, which grows the money at a faster rate as compared to simple interest. The formula calculates the interest on the fixed principal amount and the interest accumulated over the periods.

This is why lenders tend to prefer compound interest in the business. It is a drawback for borrowers; on the other hand, but from a business perspective, it is the best option out of all. It delivers a higher return rate on the money you invest, so why wouldn’t one opt for it?

How To Calculate It?

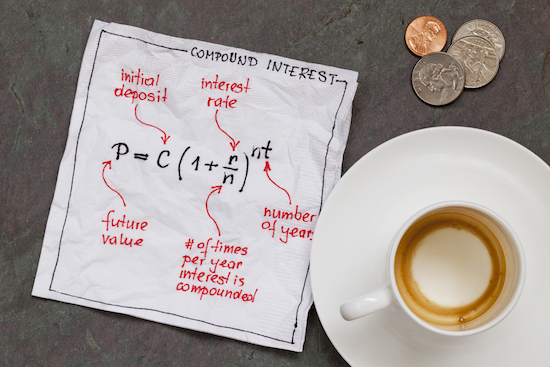

In simple terms, compound interest is interest on interest. It is calculated by multiplying the principal amount of the loan or the deposit with one plus the interest rate, which is then raised to the power of the total number of compound periods.

Further, the resulting amount is subtracted from the total loan/deposit amount to get the actual interest. Sounds complicated? If yes, then this mathematical formula will help make this clear.

= P [(1 + i)n – 1]

Sounds complicated? Well, not anymore because now you have an online calculator to do the job for you. Instead of manually calculating it, simply put in the numbers and have the calculator do the job for you. Try it out and have all calculations error-free!