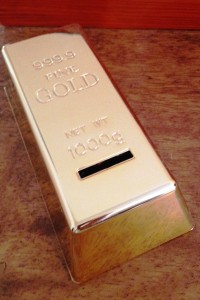

A few months ago, J. Money from Budgets Are Sexy showcased several very awesome manly piggy banks and crazy safes that people could buy on the internet. I fell in love with this bar of gold safe (see attached picture of my bar of gold below).

I have a theory that people will save more money if they have somewhere cool to put it. I have a jar labeled casino money that helps motivate me to save money! Just like nicknaming your savings accounts, naming your spare change jar can have a huge benefit and really drive your desire to save money for a specific purpose.

Compound interest is an amazing factor of investing and growing wealth. It is built into almost every financial calculation when looking at retirement, growing investments, and

Compound interest is an amazing factor of investing and growing wealth. It is built into almost every financial calculation when looking at retirement, growing investments, and  There is a difference between a good company and a company’s stock that makes a good investment. How do you choose and know when a good company may be a poor investment choice? How do you keep from falling in love with a company? These are some of the tricky questions that individual stock investors wrestle with.

There is a difference between a good company and a company’s stock that makes a good investment. How do you choose and know when a good company may be a poor investment choice? How do you keep from falling in love with a company? These are some of the tricky questions that individual stock investors wrestle with.