Note – This blog post may contain affiliate links. While all opinions are my own, and I’m a long-time user and proponent of M1 Finance, I do receive a small compensation if you choose to sign up through the links in this article.

When it comes to investing with robo-advisors, there are plenty of low-cost, automated trading platforms available today. While there are unique advantages (and disadvantages) to each one, the newest robo-advisor on the market called M1 Finance gives the more established, sophisticated investors great investing options.

Developed by a 25 year-old Stanford graduate, M1 Finance simplifies the investment process for beginning and experienced investors alike. Unlike other robo-advisors, M1 Finance does not charge a fee, and it gives you the option of taking more control over your investments if you want them (and less if you don’t).

M1 Finance the perfect investment choice for investors who like investing automatically with ETFs but also like dabbling in investing in individual stocks!

If you want more control over your portfolio and save money on trading fees, then M1 Finance might be a great addition to your ongoing investment strategy. Here’s why M1 Finance gives you great investing options.

What Makes M1 Unique?

Many online brokerage services charge fees for trades, ranging from $0.99 to $6.95 in many cases. While this is still much more affordable than a traditional brokerage, it limits the number of trades you might want to do to avoid incurring lots of fees. For the average investor, low fee trades are extremely important, and M1 Finance takes the affordability factor to the next level with its no-fee trades.

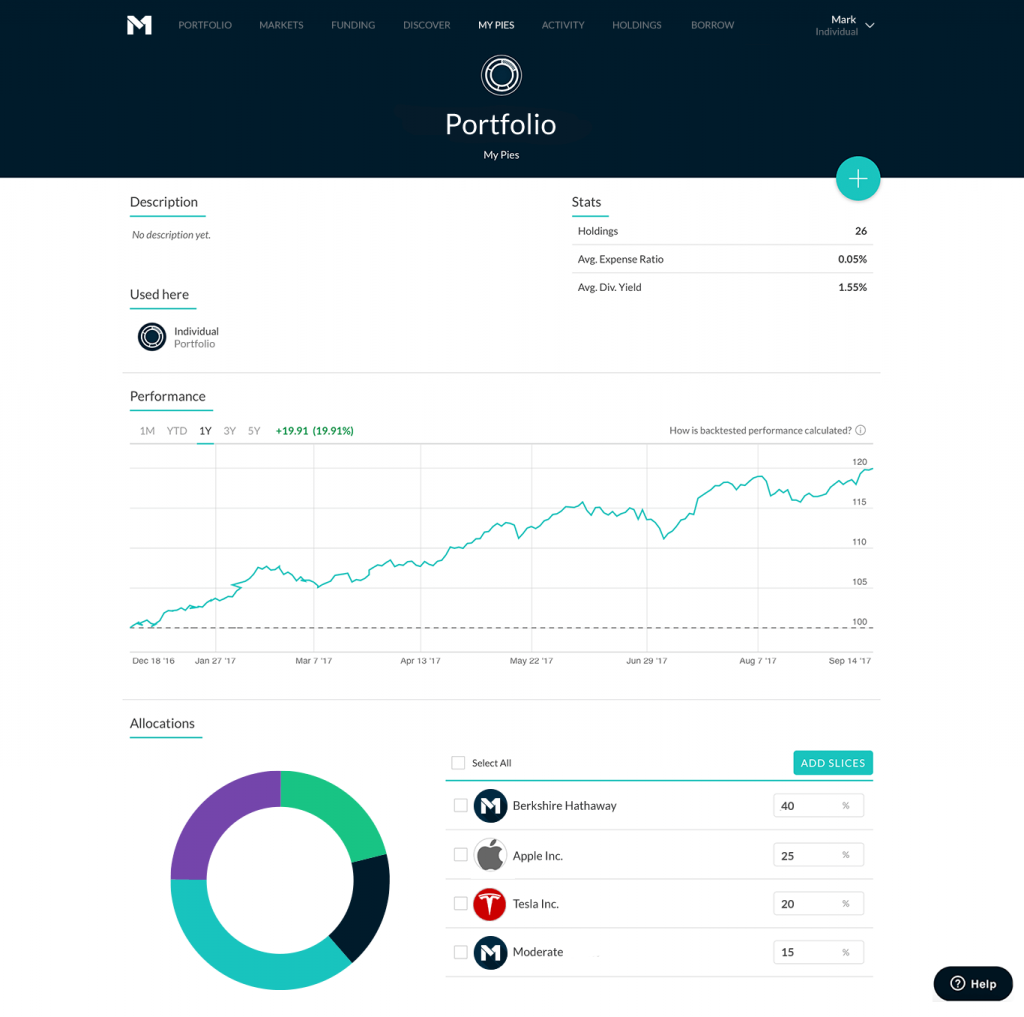

What makes M1 Finance truly unique from other online brokerages and other robo-advisors is the way it gives you more control over the allocation of your investments with the help of the Pie. With this option, you can customize how much of your money you want to invest in certain stocks, industries or ETFs by choosing a target weight for each slice of your Pie. For instance, if you want to invest in Amazon, Best Buy, Chevron, and Google, then you can choose how much you want allocated towards each stock (e.g., 25%, 10%, 25%, and 40%, respectively).

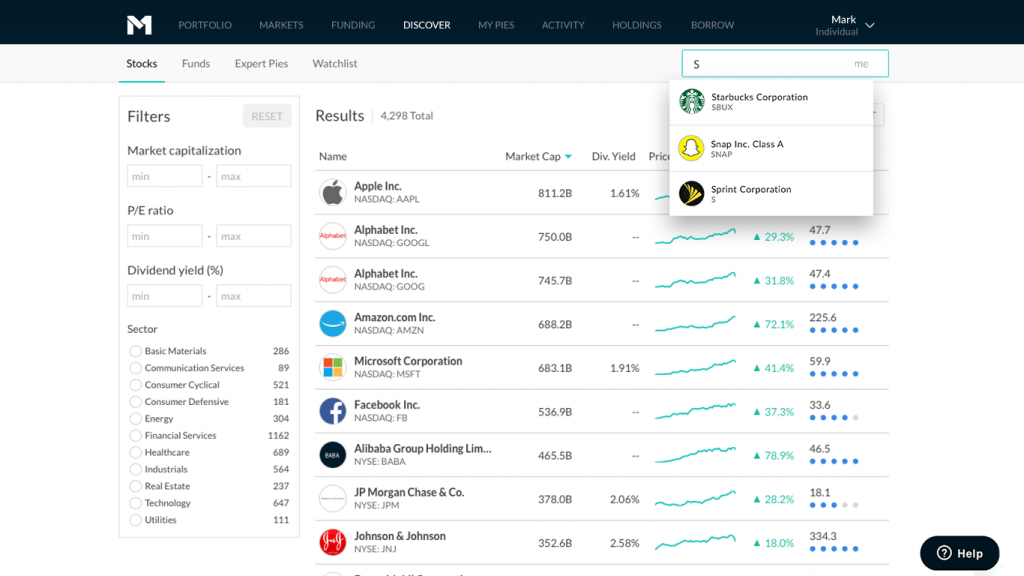

M1 Finance has nearly 2,000 Exchange Traded Funds (ETFs) available for you to choose from. And, can invest in any individual stocks that are available on either the New York Stock Exchange (NYSE), BATS, or the Nasdaq.

M1 Finance also has “Expert Pies,” which allow you to choose from various Pies designed by investment professionals. The Expert Pies are ideal for investors with specific goals (e.g., saving for a down payment on a home or retirement) and investors who want more control over how aggressive/conservative their portfolios will be. Sign Up for an M1 Finance account.

Types of Accounts Offered

M1 Finance offers six primary accounts to its users: individual, joint, retirement, trust, LLC, and corporate investment accounts. With the joint option, you can invest with a spouse, domestic partner or relative, and the retirement account option gives you access to traditional, Roth, and SEP IRAs.

Rather than investing in entire shares, M1 Finance focuses on fractional shares to keep your portfolio aligned with your target allocation figures and avoid letting your money wait idly before you can buy another full share of stock. When you trade fractional shares you can buy up to 1/10,000 of a share.

Automated Investing

M1 Finance requires absolutely minimal effort and ongoing maintenance on your part. In fact, you can even choose to automate the process by setting up regular deposits from your bank account (which doesn’t require a routing number through M1 – just your online bank log-in information).

You can invest additional funds at any time or you can set up automatic deposits into your M1 Finance account. Any additional money you invest automatically flows into the investment pies, ETFs, or companies you already established based on your investing preferences and goals. The platform offers you control when you want it or automation when you want their intelligent investing to take over for you.

M1Finance is also designed to keep your Pie balanced (according to your pre-determined allocations), so you don’t have to go into your account and manually readjust your investments whenever you deposit more money (M1 will simply do it for you).

M1Finance also engages in tax-efficient investing to minimize your tax burden when selling securities while maximizing your return on investment.

Sign Up for an M1 Finance account today!

The minimum stock buy on M1 Invest is $1.00 and the minimum cash balance for auto-invest is $25. M1 is doing this to reduce costs and to enable them to devote more time and resources to improving the M1 Invest product.

Their goal is to keep innovating for and supporting the M1 user base. Reducing the costs and burden of unnecessary transactions on their platform will help them continue to do this.

This change should not have a material impact on your ability to grow your money. You may see changes to the number of buys that happen in your account. Even at this new $1 minimum, M1 Finances is still at the lowest level in the industry, allowing you to put your money to work more efficiently.

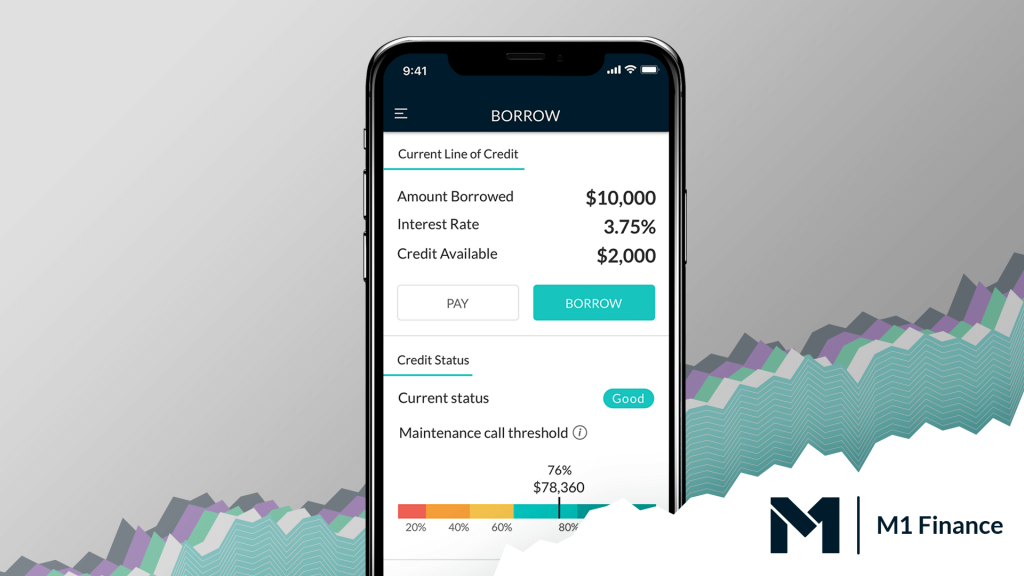

M1 Borrow

Borrowing money to invest back into the stock market was once an exclusive privilege of the super wealthy who posed extremely low risks to lenders. Now, thanks to M1 Borrow, you can borrow up to 35% of your portfolio through a line of credit, with no credit check, no additional paperwork, and no denials getting in your way.

Most brokers, such as M1 Finance, offer to invest with margin as a product that allows investors to borrow capital using the securities investors hold within their account as collateral. Margin provides investors with leverage, which can enhance your returns.

You also don’t have to use that money strictly for investments. M1 Borrow is so flexible that you can choose to spend that money on major purchases like a down payment or international vacation, refinance or pay off existing debts, or you could also reinvest that money right back into your account for higher returns.

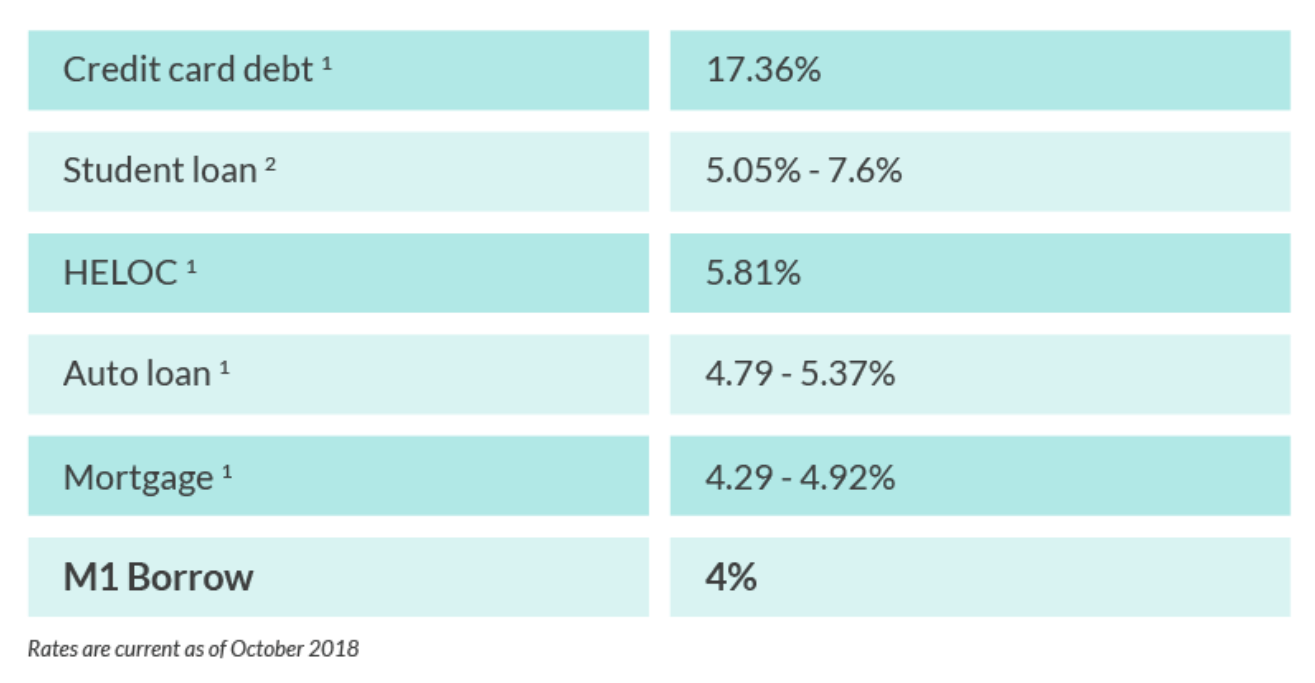

The M1 Borrow margin with your investing account costs only 4% interest. It’s one of the lowest borrowing rates on the market today. You must maintain a margin brokerage account with a balance of at least $10,000 to qualify though.

Now, M1 users with just $10,000 invested in a taxable brokerage account can instantly access a flexible line of credit at one of the lowest rates on the market. With immediate approval and only 4% APR, it’s the perfect alternative to an auto loan, HELOC, credit card, or even margin loan. You can even pay it back on your schedule.

M1 Finance recently announced a new promotion! Now you can borrow up to $5,000 free with M1 Borrow.

With at least $10,000 in investment capital in your M1 account, you borrow up to 35% of your portfolio. But, remember, this does not apply to retirement accounts.

You can borrow up to $5,000 at 0% APR from June 1st, 2019 to June 30th, 2019. You can also use margin when borrowing above $5,000 with their low rate of 4.25% APR.

Key Benefits of M1 Borrow:

- Ease of use

- Only 2 clicks before you get your loan

- Funds are instantly available in your M1 account or you can transfer to your connected bank by next business day.

- No paperwork or credit check required

- Payback on your own schedule

- No appraisal of home requirements (like HELOC)

- Access to funds without tax implications of selling securities

- Interest on M1 Borrow may be tax-deductible against your investment gains and help lower your taxes (see disclaimer)

When to use M1 Borrow:

- Large one-time purchase

- Buy more securities

- Be more efficient with capital

- Kid’s college tuition

- Consolidate other loans at a lower rate

- And, more…

How M1 Finance Earns Income

M1 Finance is free for individual investors. The service has no trading commissions, no account maintenance fees, and no charges for deposits or withdrawals.

Instead, M1 Finance earns income through the interest on margin accounts. They also earn revenue on cash balances just like any other investment firm and financial institution.

One Thing I Love About M1 Finance

I’m personally using an M1 Finance account to test my stock picking prowess against an index fund. I’m taking half of my investment and investing in an S&P 500 index fund. Then, I’m using the other half of my investment to pick individual stocks.

Be sure to check back here and future blog posts to find out how I’m doing!

But, if picking individual stocks isn’t for you, that’s okay. M1 Finance has a lot of options for you as well. There are over 2,000 ETFs for you to choose from though M1 Finance.

Just like me, you can choose a truly customized portfolio either of ETFs, individual stocks, M1 Finance pies, or a combination of all three to help you accomplish your goals.

Investing with Confidence

Like other investment accounts, your account is covered by SIPC insurance for up to $500,000, including $250,000 in cash, against broker failure in the case of fraud or mismanagement.

Just like other financial institutions, M1 Finance uses 256-bit SSL data encryption. Additionally, they offer two-factor authentication to keep your account secure as well.

M1 Finance uses a Third Party Custodian, Apex Clearing, to hold your assets. M1 Finance cannot access your money. You are the only one who can make a deposit or withdraw from your account.

M1 Finance is a registered broker/dealer with FINRA, and subject to regulation and oversight just like any other registered broker/dealer.

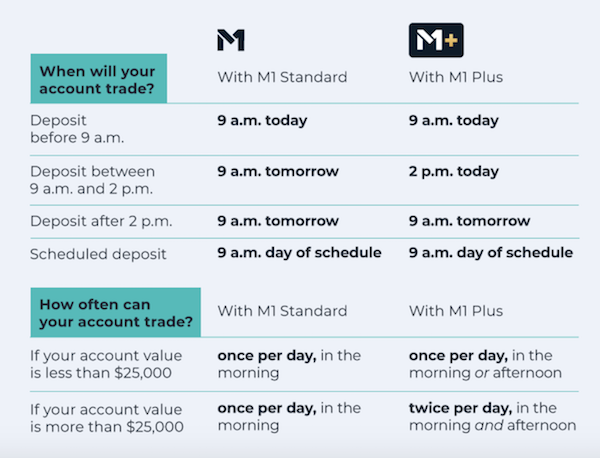

M1 Finance makes all investor trades at 9 AM Central Time each day. There’s no day trading with M1 Finance. It’s hard to move fast, in and out of positions with M1. M1’s automated trading includes all buy/sell orders during the first trading window after submission. You can always see your pending calculated trades in your account’s ‘Activity’ tab.

The trading window is the window of time each weekday when M1 makes all trades for user accounts. M1’s trading window benefits users because it helps keep M1’s management fees low since M1 is only trading one time per day. M1 is a long term investing platform, not a trading platform, so the timing of trades is less important.

M1’s trading window begins at 9am Central every day the New York Stock Exchange (NYSE) market is open and runs until all orders have been completed. All changes to your portfolio made before 9am CT on days that the NYSE is open are generally executed the same day during M1’s trading window. Accounts trading will see updates after the trading window has closed for the day.

No trading can take place outside their trading window each morning. So, keep that in mind. M1 Finance is looking at adding new trading windows in the future.

Now M1 created a new trading window, exclusive for M1 Plus members.

This new trading window will be available in the afternoon while our morning trading window at 9 a.m. CT will also remain available.

The restrictions for accounts below $25,000 are due to Pattern Day Trading rules.

M1 Spend

M1 Spend is a checking account and debit card that integrates seamlessly with M1 Invest and Borrow. It will launch later this year in 2019.

M1 Spend is an FDIC-insured checking account and debit card that seamlessly integrates with the current M1 application. M1 Spend is the best of digital banking, allowing you to direct deposit your paycheck into M1, pay bills from M1, and spend your money with an M1 Visa debit card. We’re even launching a premium version that includes an industry-leading 1.5% APY interest and 1% cash back on all purchases through the debit card.

M1 Finance users can choose to use the standard card (free and included in their existing M1 account) or opt into M1 Plus for just $50 when they early enroll. All M1 users will be able to receive paychecks, pay bills, and spend with a Visa debit card backed by Lincoln Savings Bank (member FDIC).

With M1 Plus, users gain access to exclusive rewards and features, such as…

- Early access to M1 Spend

- A premium tungsten debit card

- 1.5% APY on cash held in their M1 Spend checking account

- 1% cash back on all purchases

- 4 free ATMs per month

- A discounted rate for M1 Borrow

Though these additional features do come with a fee, the primary benefit of M1 Spend is its integration with your investment portfolio and a low-cost, flexible line of credit, allowing our customers to manage their money in one convenient, intuitive platform.

The core of M1 is still (and always will be) free. Introducing M1 Plus for a small annual fee simply allows us to continue to provide this core product for free.

Getting Started Investing with M1 Finance

Opening an account with M1 Finance is easy. First, you simply create an account. You can sign up for a free M1 Finance account here!

Next, you select your pies or individual investments. Select the type of account you want to open. Like I mentioned before, you can sign up for a taxable account, Roth IRA, Traditional IRA, SEP IRA, Trusts, or joint account.

Then, you fund your account. There is no minimum required to fund your account.

Should You Join M1 Finance?

M1 Finance seems to have it all: automated investing, no-fee trading, tax-advantaged accounts, and greater control over your portfolio (unless you want M1 to do all the work, in which case it excels in hands-off investing too).

The option to borrow money from M1 Finance with a very reasonable interest rate makes this platform even more favorable for investors who want to save time and money without running into the same pitfalls of other brokerages and/or robo-advisors (such as high account balance minimums or high trading fees).

It’s a transparent and easy-to-use platform. So give it a try. Click here to sign up for a free M1 Finance account today!Using margin involves risks: you can lose more than you deposit, you are subject to a margin call, and interest rates may change. To learn more about the risks associated with margin loans, please see our Margin Disclosure (https://s3.amazonaws.com/m1-production-agreements/documents/Margin_Disclosure.pdf). M1 Borrow available on margin accounts with a balance of at least $10,000. Does not apply to retirement accounts.

Borrow your first $5,000 at 0% APR from 06/01/2019 to 06/30/2019. Discount will be applied to your account at the end of the month. The investment interest expense may be deductible if you itemize deductions and other criteria are met. M1 does not provide tax advice and we suggest you consult a tax expert regarding the deduction of investment interest expenses.