There are plenty of reasons why debit cards are not only still relevant, but also incredibly useful for consumers – even in an era of competitive credit card rewards offers and our seemingly insatiable appetite for buying things now and paying off these purchases later.

If you’re a parent who’s trying to teach your kids about personal finance, then prepaid debit cards are an excellent option for developing good spending and saving habits from an early age. Alternatively, perhaps you’ve struggled with racking up credit card debt and need something to break you out of an impulsive spending habit – a prepaid debit card would also help you become a better budgeter in this scenario.

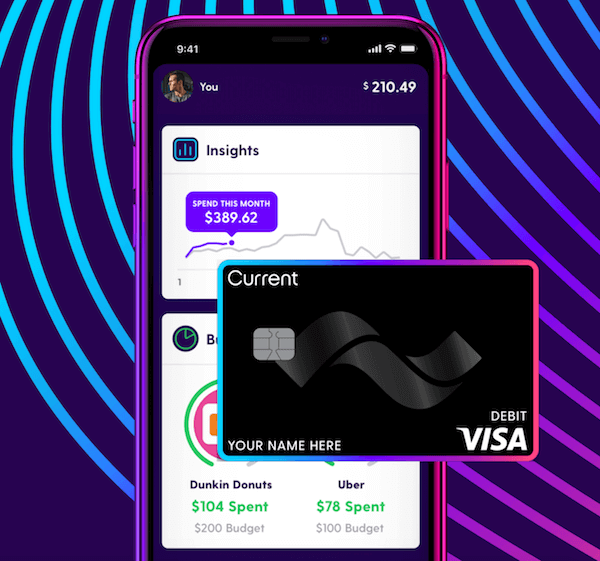

But why settle for just any debit card when you can have one with the latest tech and security features? This is the premise behind Current, a debit card synced with an advanced, yet incredibly user-friendly app designed to help consumers track their spending more efficiently and save more money.

Regardless of your reasoning for wanting or needing a prepaid debit card, Current might be an ideal option for your situation. Here’s why.

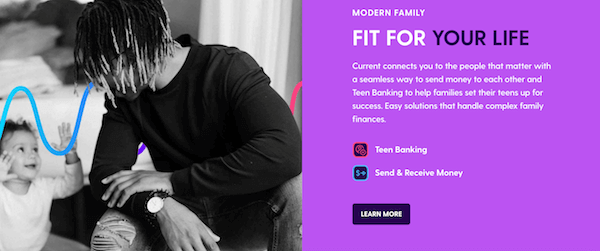

Parental Controls for Personal Finance

Current is primarily geared towards parents of teens and tweens who want tech-savvy strategies for teaching their kids about personal finance. As much as we love the envelope method for budgeting, we have to recognize that this generation has never known a world without the Internet, smartphones, and apps. So, Current is a great way to teach them about proper money management with the same tools they’re already experts at using in their personal lives.

When you sync up your accounts with your teens’ Current accounts, you’ll be able to send money instantly (good for emergencies), schedule allowances to virtually pay your kids for completing chores, and set up a direct deposit through your teen’s job(s) to give them quick and easy access to their paychecks.

To control your kids’ spending, you can also customize the maximum daily ATM withdrawal amounts and set daily purchase caps. If there are certain purchases your teen should not be making, then you as the parent are also able to block certain businesses by type to prevent your teen from spending money in frivolous and/or harmful ways.

Convenient Banking for Kids and Teens

Current is great for both parents and teens because it gives them more freedom over their finances than they’d otherwise have with a regular checking account. With a Current prepaid debit card, teens can shop online, use Apple Pay or Google Pay, and/or set up automatic transfers to a savings account.

Current also lets teen users set savings goals for themselves and activate round-ups on purchases to boost their savings even more with the Savings Pods feature. The Current app will then keep track of their savings transactions and current balance in relation to their savings goals. There’s even a donation feature that lets teens contribute money to their favorite charities with funds from their Current accounts.

Direct Deposit Features

Some of the most convenient features accessible for Current users involve direct deposits. With Current, your teen can receive a direct deposit from their work up to 2 days early, and money transfers between friends and family members are instantly available for no additional charge.

Even if your teen gets physical paychecks in lieu of direct deposits, they can still deposit them into their Current account using the check-cashing feature available through the app.

How Much Does Current Cost?

Whereas many student checking accounts charge anywhere from $5-15 per month just in “account management” or “account maintenance” fees, Current charges just $36 per year for access to most of its best features. There are no transaction fees, transfer fees, minimum balance fees, overdraft fees, or inactivity fees involved in Current – the only fee you might have to pay is the $5 card reorder fee for instances where the card is lost or stolen.

Current offers two different plans: basic and premium. If you want the bonus features (premium black card, instant credits for gas holds, early direct deposits), then it’ll cost $4.99 per month in addition to the $36 annual fee (the basic plan costs $0/month).

Current Safety and Security

Just like any other bank, Current is FDIC insured for deposits up to $250,000. On the parental control side, you’ll be able to view your teen’s spending habits and receive instant notifications about any purchases made with the card. Transactions are secured with EMV chips, and you can maximize app privacy by implementing fingerprint and facial recognition locks to limit access to the accounts.

Should You Get a Current Prepaid Debit Card?

It just takes a few minutes to set up an account with Current and the benefits for parents and teens alike are almost limitless. For parents, you’ll enjoy peace of mind knowing what your kids are spending and saving money on. For teens, they’ll enjoy more freedom to use their money electronically – instead of relying on cash allowances until they’re 18 – and they’ll learn more about good financial management skills along the way!

For just $36/year, Current is a win-win for everyone. Click here to sign up!