In the past, I had to do all of the legwork myself. I had to find new loans on Lending Club to invest in. Now with Lending Club’s Automated Investing, the website does all the work for me.

Lending Club is a great investment. The loans that you invest in can be a great addition to your overall investment portfolio. It has a proven record of providing a greater rate of return than other investments. I especially like Lending Club as an alternative to government bonds, money market funds, and other low yield investments.

Lending Club Is a Great Investment For Passive Income

Lending Club can be a great way for you to have passive income through the use of compounding interest and automatic investing. Much like a dividend reinvestment plan (DRIP), Lending Club allows you to systematically invest money each month and let the interest you earn compound into a greater rate of return.

In the past, you had to pick the loans that you invested in through Lending Club. Now, the investment company has a service called, Lending Club’s Automated Investing, which automatically invests the cash in your account for you based on your investment strategy and preferences.

So, for example, most of the loans I invest in through Lending Club make payments back to me each and every month. Like a bank, it is a combination of principal and interest. I looked back, and each loan typically pays me $0.50 to $0.60 each and every month.

Since there is a minimum investment of $25 in each loan, you would need approximately 50 loans each paying you $0.50 to produce $25 each month in income. This is truly passive income.

You can use that $25 per month to have Lending Club invest for you in a new loan automatically each month through Lending Club’s Automated Investing program.

I’ve been trying Lending Club’s Automated Investing program out for a month now, and I love it. I really do. I like having Lending Club automatically pick the loans for me to invest in. It is a great service that I’m really getting into as a way to build a passive income stream for retirement.

Earning Lending Club Passive Income with Automated Investing

Lending Club passive income is put to work using the company’s newest tool, Automated Investing. You select your investment criteria on the site, and Lending Club automatically picks matching loans for you to invest in. It automatically invests in them when you have cash in your account, leaving you completely hands-free to earn passive income with Lending Club.

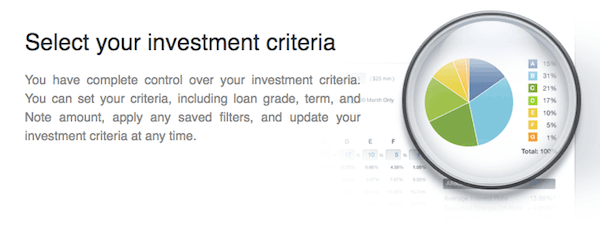

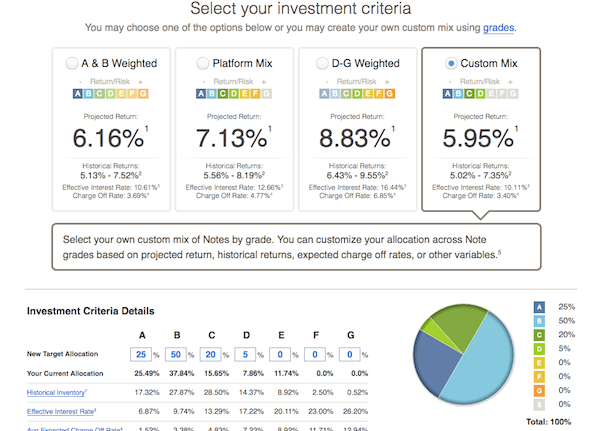

I really liked how you can hone your investment criteria on Lending Club’s Automated Investing program. The site gives you some pre-made portfolios of loans that you can choose from based on your risk tolerance and the expected rate of return that you are looking for. Lending Club passive income that you’ve earned from your other loans is then put to work for you automatically.

Lending Club’s Automated Investing also allows you to track the number of loans that you have versus the number that you want in each risk level. Lending Club ranks their loans that you can invest in by letters similar to how bonds are rated. You can choose from A to G level loans with A loans being the least risky and G level loans being the most risk with rates of returns that correspond to those levels of risk.

Once Lending Club invests in loans for you, you receive an email notification. You can also see the loans that the service invested for you on your dashboard on the website. It’s all very transparent and the information is readily available to you at all times.

Lending Club gave me a few set choices on how they would invest my cash in the future through the Automated Investing program. You can see three of the recommended portfolios in the picture above on the left with 6.16%, 7.13%, and 8.83% estimated rates of return.

I opted to change their loan mix based on my risk profile. I told the system not to invest in the riskier E, F, and G level loans. Instead, I told the program to focus its efforts only on the safer A, B, C, and D level loans. Of course, this reduced my expected rate of return to 5.95%.

Be sure to check out my complete guide on how to earn passive income with Lending Club.

More of the Finer Details of Lending Club’s Automated Investing

Lending Club’s Automated Investing service attempts to place orders on your behalf up to four times per day when new loans are listed, with the goal of deploying the cash in your account as quickly as possible in accordance with your investment criteria.

But, you can always set your investment criteria to allow cash to accumulate in your account so that you can make a withdrawal. You can pause or cancel Lending Club’s Automated Investing at any time.

The frequency of orders is based on the cash balance of your account, availability of loan inventory matching your investment criteria, and demand from other investors.

The cash in your account may be deployed immediately or over a long period of time. And, there may be weeks when many orders are placed and weeks when no orders are placed. You may also continue to place manual orders at any time like normal.

There is no additional fee for using Automated Investing. Standard investor servicing and collection fees apply to any Lending Club note you hold in your Lending Club account.

I can’t say enough about Lending Club’s Automated Investing service. I’m really enjoying using it. I think that it is a great way to increase your passive income and add another stream of income that you can have in retirement or just an added benefit to your overall investment portfolio.

Have you used Lending Club’s Automated Investing? Do you think it’s truly passive income?

Subscribe By Email

Like this article? Sign up for Money Q&A’s Email Newsletter, and we’ll send you a regular digest of our newest articles each week as well as exclusive giveaways, deals, and tips just for our email subscribers.

It is full of the answers to your most pressing money, investing, retirement, insurance, and other financial questions. And, it is all free! So, why wait? Click here to sign up now.