Did you know that consumers waste more than $34 billion per year on overdraft fees? This figure rivals Great Recession figures, though overdraft fees were cheaper back then (around $20 for banks and $15 for credit unions, compared to $30 for banks and $28 for credit unions nowadays).

Since there is no benefit to paying overdraft fees – they’re just penalties for folks who overdrew their accounts to pay the bills before their next paycheck rolls around – it’s alarming to think about how much money individuals and families living paycheck to paycheck might be losing to overdraft fees each year.

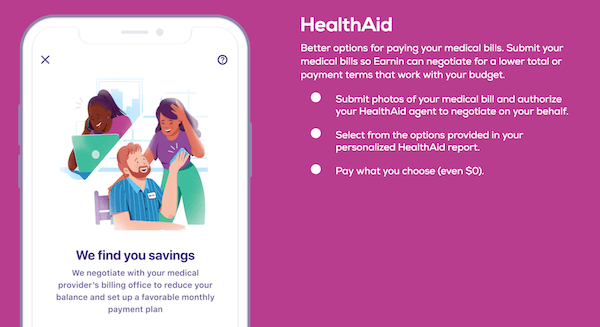

While most people would like to keep enough cash on hand to cover their bills, unexpected expenses crop up all the time (medical bills, car collision requiring significant repairs, insurance rate hikes, etc.). Unfortunately, a study conducted by the Federal Reserve that more than 40% of Americans would not be able to cover a $400 emergency expense with cash because they don’t have enough money in savings. If you’re currently living paycheck to paycheck and need more stability in the financial side of your life, what can you do?

This question was the founding principle of Earnin (formerly known as Activehours). This community-run platform allows people to access a portion of their paycheck in advance without paying hefty fees for getting their cash early. If you would like to stop losing money to sky-high overdraft fees, then here are some ways Earnin can transform your ability to pay the bills on time.

Every Day Can Be Payday

Imagine if you could get paid at the end of the workday, instead of waiting for the next payday to arrive. If you’re like millions of other people, perhaps your billing cycles are all over the place and some payment deadlines come before the next pay period, leaving you scrambling to get the cash you need to cover your bills.

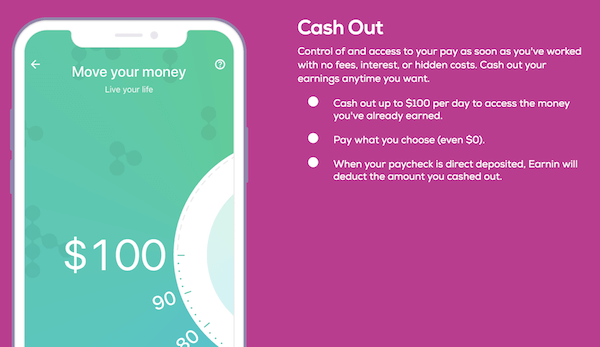

Thankfully, Earnin is the answer to incompatible paycheck and billing schedules. Whether you need cash to Venmo a friend (without paying the 3% credit card fee) or you need money to cover your utilities or cell phone bill before you get hit with a late charge or pay an overdraft fee through your bank/credit union, Earnin has you covered with cash advances.

Avoid Overdraft Fees

While you’re only able to cash out a maximum of $100 each pay period when you’re first starting out with Earnin, over time, that maximum will go up to $500 (as long as your income and use of Earnin remain consistent). This might not sound like much, but you might be surprised by how often people incur overdraft fees that cost more than the actual amounts they overcharged (though some banks and credit unions do not charge overdraft fees if you overdrew by $5 or less).

If you’re tired of risking/incurring pricy overdraft fees simply because your paycheck didn’t hit your account in time to pay the bills before their deadlines, then Earnin is one of the best ways you could possibly get the money you need without paying any fees.

Who Can Use Earnin?

Earnin may sound exclusive, but the entry barrier is actually pretty low. As long as you get a regular paycheck (weekly, biweekly, monthly) directly deposited into your checking account by your employer, then you are most likely eligible to use Earnin.

Additionally, you must have a fixed work location or an online timekeeping system through your employer (for virtual teams). Earnin does not presently work for people collecting unemployment, disability checks, or Social Security, and the app doesn’t work with savings accounts (only checking).

How Much Will Earnin Cost Me?

Earnin is such a helpful service that it must cost at least $5 per month or transaction, right? Wrong! Earnin costs its users nothing. It is a community-run platform that relies entirely on tips from users as its sole source of revenue.

You won’t run into any fees or hidden charges while using Earnin, though you will likely be encouraged to give back every once in a while via tipping (which is completely optional).

Should You Try Earnin?

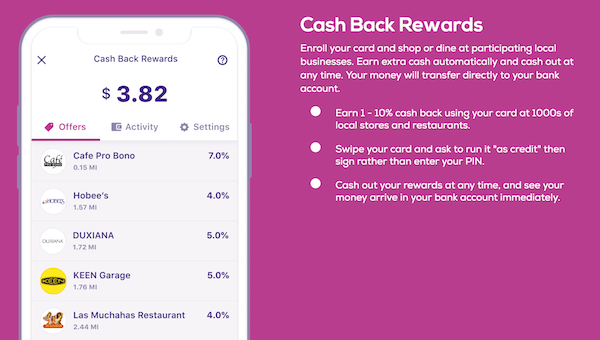

Earnin works on both Android and iOS devices, so pretty much anyone who meets the 3 basic eligibility criteria and owns a smartphone can use Earnin to get the money they need before their paychecks are deposited into their checking accounts. It’s an incredibly simple, useful and cost-effective way to stabilize your financial situation without worrying about where you’ll find the money to cover your expenses while you wait for your next paycheck.

It only takes a few minutes to set up and costs nothing for users, so try out Earnin for a few months to see how it fits into your financial management strategy.

Advertiser Disclosure: The offers that appear on this site are from companies from which this site receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all financial services companies or all of their available product and service offerings.