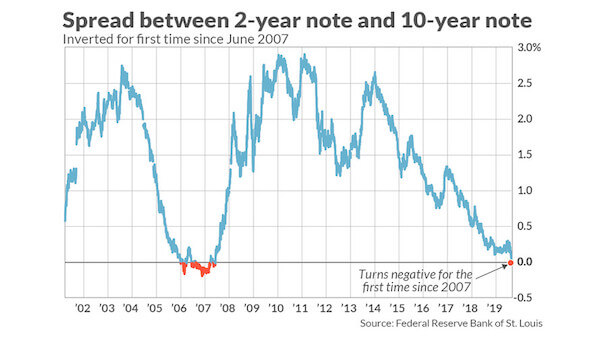

There’s a lot of anxious buzz in the news lately about the potential for a market downturn – or even another “great recession” as some outlets are calling it – which was sparked largely by the brief inversion of the yield curve on Wednesday, August 14th. Specifically, the yield on 10-year U.S. Treasury notes fell lower than yields on the 2-year Treasury note, which left investors unsettled over the possibility of a recession hitting the U.S. economy in the near future.

As an investor yourself, should you be worried about the yield curve or should it be chalked up to overblown media hype? The answer is more considerably complicated than a simple “yes” or “no” in regards to whether the yield curve is important; there are many other factors to consider and timing the markets rarely works well for any investor (even the most experienced ones), so now is not the right time to withdraw all your investments in a panic and hunker down for another 2008-esque doomsday scenario.

Before you rush to withdraw from the stock market and pour money into gold investments, there are some things you need to know about the yield curve to help you make informed investment decisions and maintain long-term gains for your portfolio, regardless of whether another recession hits the U.S. economy within the next 1-2 years.

What is the Yield Curve?

The “yield curve” is oftentimes referred to as the “benchmark curve” that visually depicts yields among U.S. government-backed maturities such as Treasury notes and bonds. Most of the time, the yield curve is positive, which signifies returns on investment for those who buy notes and bonds. The yield curve is typically viewed as a reliable indicator of a potential recession on the horizon, but this shouldn’t be mistakenly viewed as a guaranteed predictor.

Concerns over short- and long-term economic growth arise when a yield curve begins to flatten; bond investors generally pay close attention to this economic indicator because it can majorly impact their returns on investment over time. Short-term bonds and Treasury notes (3 months to 2-5 years) tend to have lower yields in comparison to long-term notes and bonds (10+ years) because they’re less risky for investors.

On a graph, a normal yield curve slopes upward from left (short-term maturities) to right (long-term maturities). This reflects investors’ expectations that the economy will generally grow at a similar pace over a long enough timeframe.

What Happens When the Yield Curve Inverts?

An inverted yield curve looks the opposite of a normal yield curve: it slopes downward from left to right, which means there are lower yields on long-term maturities in comparison to short-term maturities. But why would anyone invest in something for the long-term if it offers lower gains than what they could earn on short-term investments?

One reason for this might be investors expect long-term yields to drop even lower and they want to get their foot in the door before those yields plunge even lower (again, no guarantee they will). In economic terms, lower long-term yields in comparison to short-term shields can mean that a recession is likely coming soon, or at least economic growth may slow down in the coming months (which could further depress yields on maturities).

Graph Source – Market Watch

Why Are Investors Concerned?

Just before the last seven recessions in the U.S. economy, the yield curve – specifically the 2-year/10-year version – inverted, with the last time being 2007/2008. The Federal Reserve typically monitors the 3-month/10-year yield curve to assess the likelihood of impending economic recessions, but bond investors largely prefer the 2-year/10-year yield curve as their key benchmark for determining whether or not a recession is coming soon.

Is There Another ‘Great Recession’ Upon Us?

It’s already extremely difficult to predict economic activity that hasn’t happened yet; making frantic investment decisions based on whether or not a certain yield curve is flattening or inverting is likely a poor strategic move. Furthermore, trying to time the markets is tricky business; many investors in the past have bailed too early and missed out on tremendous gains while attempting to avoid the consequences of a potential economic downturn.

Just look back to 2007-2009 and imagine what financial position you’d be in today if you sold a majority of your investments in the midst of the markets’ downward spiral. You likely wouldn’t have benefited from the massive gains that have occurred since then, so battening down the hatches and riding out the storm until the markets bounce back – as they always have – is likely preferable to jumping ship now simply because the yield curve inverted for just one day in August.

Markets are inherently cyclical; your best strategy moving forward would be to hold steady, ensure you have an adequate emergency savings (so you don’t have to withdraw from your portfolio out of financial necessity) and invest in stocks, mutual funds, and bonds when the markets ultimately do go down so you can take advantage of the substantial gains potential when the markets bounce back.