Regularly monitoring your credit reports is crucial for maintaining a good credit score. However, it can be difficult to keep track of all your credit details when you have multiple credit cards, loans, and other financial information scattered across many different accounts. While some credit card companies report to one or two bureaus, other lenders might report to another bureau, which means there’s not much cohesion between your credit reports from TransUnion, Experian and Equifax sometimes.

If you wished there was an easier way to keep track of your information coming and going from all 3 bureaus, then the myFICO Ultimate 3B ongoing report program might be a good fit for you. Get Your Credit Scores & Reports From All 3 Credit Bureaus.

The programs myFICO offers for credit monitoring, identity theft protection, and other financially sensitive services are ideal for anyone who wants to protect their personal and financial information both online and off. Compared to myFICO’s $19.95/month Basics 1B report (one bureau – Experian), the myFICO Ultimate 3B (three bureaus) ongoing report costs $29.95 per month and includes a wide range of nifty features:

Quarterly Credit Reports from All 3 Bureaus

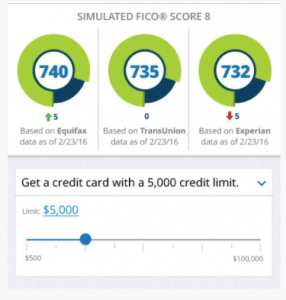

Unlike many free credit score services – like Credit Karma or credit scores provided by your credit card company – myFICO Ultimate 3B gives you access to the latest credit scoring model and credit scores from all 3 credit reporting bureaus. This way, you’ll get a comprehensive view of your financial situation, including a historical tracking graph that depicts how your credit score has changed over the course of a few weeks, months, or even years.

Credit Score Alerts

Another major advantage that myFICO’s Ultimate 3B service offers is the 24/7 credit monitoring and alerts via email, text message or myFICO app notifications. Whenever myFICO detects a change on any of your credit reports from the 3 bureaus, you’ll be notified within 24 hours of the reported change. This can help you catch errors and fraudulent accounts opened with your personal information long before they become serious issues.

Identity Theft Insurance and Monitoring Services

Sure, other websites and credit card companies offer similar (but not as extensive) credit monitoring services free-of-charge. So why should you pay $29.95/month for myFICO’s Ultimate 3B service? The answer lies in the identity theft monitoring and insurance programs.

Every day, myFICO scours the Internet for underground websites attempting to illegally sell your personal information. The black market surveillance program scans thousands of illicit websites to see if any of your personal information crops up and reports back to you where the information came from. The identity theft protection service also searches the web for aliases using your personal information so you can pinpoint fraudulent activity by scammers operating with your name.

After identifying any threats to your identity and financial records, you’ll be able to proceed with a number of options like speaking with a certified myFICO resolution specialist (24/7 availability), filing fraud reports, freezing your credit reports, and more. This service is incredibly useful for detecting and dealing with identity theft threats, especially when coupled with the Ultimate 3B program’s $1 million theft insurance, which covers legal fees, lost wages, and other expenses related to incidents of identity theft.

myFICO Mobile App

Should You Get the Ultimate 3-Bureau Report?

Numerous websites offer free credit estimation and tracking, but few online resources offer the comprehensiveness, protection, and peace of mind that myFICO’s Ultimate 3B program offers. Why limit yourself to checking credit records from one or two bureaus when all three manage your information and could have errors or instances of fraud arise at some point?

You’re entitled to one free credit report from each bureau every year, but by the time 12 months pass, a scammer might have already swindled your personal information and could be selling it on the black market online without your knowledge.

Especially after the massive Equifax hack, protecting your most private information should be a priority, and myFICO’s 3-bureau credit monitoring, credit report change notifications, and identity theft monitoring and insurance offer an excellent, all-inclusive package for consumers to keep track of all of their personal information online.