Student Loan Hero was founded by a man who struggled, yet successfully paid off over $100,000 in student loans. Given the shocking statistics surrounding student loans, he wanted to help others pay off their loans as efficiently as possible, which led him to create the free Student Loan Hero platform.

What Is Student Loan Hero?

Student Loan Hero is a fantastic resource to start if you’re looking for ways to pay off student loan debt faster.

Here are some key features you won’t want to miss about Student Loan Hero:

Student Loan Hero’s Features

Student Loan Hero’s dashboard was clearly designed for ease-of-use, with a simple navigation toolbar at the top and useful visuals to help you chart your loan repayment progress. Student Loan Hero’s purpose is pretty straightforward: to help other people repay their student loans faster by offering a vast database of information (on nearly every student loan-related topic imaginable). And, the site also links to useful websites to help folks lower their debt loads or learn whether their loans are eligible for one of the many available loan forgiveness programs.

Student Loan Hero even covers topics like student loan default to help anyone bogged down with educational debt get back on their feet without serious detriment to their personal financial situation. No matter where you’re at in your student loan repayment process – just took out loans, trapped in a seemingly endless cycle of debt, or on the verge of finally paying off your balances and need some more help – Student Loan Hero is a great resource for helping people with their student loans, free-of-charge.

Personalized Repayment Options

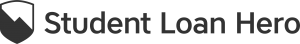

If you want to reduce your student loan interest payments, then consolidating multiple loans into one loan with a lower interest rate could be an ideal choice. Student Loan Hero lists several low-interest refinancing options from private lenders, with rates ranging from 2.10% to 9.85%, depending on your financial history and credit background.

What is Digit? I’ve been obsessed with

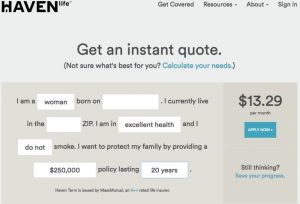

What is Digit? I’ve been obsessed with  Here’s what their smartphone all and my account looks like with Digit. It is super simple, even with their design. They make it simple to save, and the app keeps it simple too.

Here’s what their smartphone all and my account looks like with Digit. It is super simple, even with their design. They make it simple to save, and the app keeps it simple too.