Don’t get me wrong. I’m not mad, and I know that I shouldn’t be comparing myself to others. We’re all in separate places with different goals and situations in life. But, I can’t help but continue to dwell on J Money’s net worth updates when he posts them every month.

But, this time, I think I’m onto something. I think that he’s forgetting something, and subsequently so am I. We all might be forgetting something in our calculations. We all might be richer than we realize! Are you making this key mistake when you calculate your net worth? I bet you are, and you’re not alone.

Maybe there is more to these net worth numbers and the simple calculations of our assets and liabilities. I think J Money is unrepresenting his net worth and leaving money on the table. I think we all are. Our net worth numbers can be even larger, and maybe some of us are closer to J Money than we think.

You’re Leaving Out a Few Assets

But, we are leaving out key assets to our calculations. It struck me when I had an argument with my friend Blake a few months ago whether or not your cars deserve to be included in your net worth as an asset. It does! I agree with J in that respect. My friend was leaving out his cars as an asset, but he was surely including his car loans in the list of liabilities. This greatly underestimated his net worth.

So, that got me thinking about other assets that we typically do not include in our net worth calculations. I think that we are a little better off in our wealth than we all think.

Other Assets Missing from Your Calculations

I can remember getting my wife’s wedding band and engagement ring appraised after we got married. We needed to get an additional rider on our homeowner’s insurance policy because there is typically a very low threshold for jewelry. The same is often true for expensive electronics and gun collections. You may want to check with your homeowner’s insurance company.

J Money may even need to check on whether or not his coin collection is covered. But, that brings up the question – Are these guns, coins, electronics, jewelry, and the like included in your net worth calculations? Not many of us are adding them to the totals, and we should be. We’re leaving money on the table so to speak. We have more assets than we realize.

What about including websites and blogs that you own in your net worth calculations? The thought hadn’t really struck me before. But, they can be a great asset that you should include.

I tell people that I’ve lived the blogger’s dream. A couple of years ago, I was lucky enough to sell a blog that I had started just as a hobby. Most bloggers start with great intentions and want to help others. I started with a passion for personal finance, education in the subject, and then a love a writing. It blew my mind that years later a company would pay me money to buy the blog that I started as just a hobby.

Remembering that made me think about how the cash from the sale of the first blog boosted my net worth that year. It also made me realize that I don’t include the value of my blog, Money Q&A (I ended up starting another blog eventually.), in my current net worth calculations.

By simply using a simple multiple of the blog’s annual earnings, I’m leaving thousands of dollars off of my current net worth calculations. I could only begin to guess what Budgets Are Sexy may be worth and what it would add to J Money’s net worth calculations when he adds it to the total. But, he should! We all know what an incredible asset it is!

We’re a Society of Collectors

Americans love to collect things. And, often times, our collections are expensive. J Money has talked about his love of coin collecting here on his blog many times before.

Coin collecting is just one example. You don’t have to be an art collector with an Andy Warhol on your walls to have something that can be added to your net worth bottom line.

But, I’m quite sure that you have a collection of something that is quite valuable when you add it all up. Do you have antiques, a baseball card collection, a stable of blogs, or a rare first edition book collection? These are just a few examples of things that we collect that can be added to your net worth calculations.

Where do you draw the line? What should be included in your list of assets when you’re calculating your net worth?

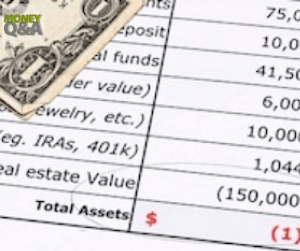

How Does Your Net Worth Compare?

To some, calculating a net worth raises questions. Are you winning? Are you on track with your saving and investing? And how does your net worth rank compared to others?

Only you can answer the first two. According to the Federal Reserve Survey of Consumer Finances, the median net worth of all families was $81,200 in 2013. The average net worth of families in America was $534,600. The median represents the halfway point — half of all families have higher net worths, half less. The average adds up all those net worths and divides by the number of families. It’s so high because of the immense wealth of the 1%.

The Fed survey offers other breakdowns. For example, the average net worth for persons age 35-44 was $347,200. Homeowners amassed an average net worth of $783,000, vs. just $70,300 for renters.

You can see a rough calculation on where you stack up against other people your age and income on CNNMoney’s Net Worth Calculator. It’s a good tool to give you a quick snapshot, but, of course, you should take results from all online calculators with a big grain of salt.

There’s a danger to comparing yourself to the Joneses. Instead take a moment to calculate your net worth every three months. Use it as a baseline to assess your goals. Are you on the right track? Do you need to make adjustments? Tracking your net worth can be a valuable tool to achieve your financial goals.

Calculating Your Net Worth Starts the Conversation

Where is your family financially? Are you saving as much or investing for retirement enough? Are you where you want to be? Do you think that you’re on the right track, or do you need to make adjustments?

By calculating your net worth, you have a starting point to build a conversation with your spouse or loved ones. Most American families have one adult who typically handles the finances for the household. Reviewing your net worth periodically will help to bring the other spouse into the conversation.

By calculating our net worth regularly, my wife and I sit down to discuss where we are and where we want to go financially with our lives. It’s a time for us to re-examine our financial goals and make new ones. Often we don’t change our goals. Our net worth confirms that we’re on the right track. But, there are times when we reassess things and make changes.

This quarterly meeting is the perfect time for me to help include my wife in the midterm and long-term financial planning and goal setting for our family.

What do you think? Do you include coin collections, cars, hobbies, blogs, and the like in your net worth calculations? Why or why not?

Note: Portions of this article originally appeared on AOL Daily Finance and is reprinted with permission. See the full article on AOL Daily Finance.

I like the idea of including the value of your blog in net worth calculations. Maybe use an earnings multiplier of four?

I’ll be sure to include my blog ($0.78!) in my net worth calculations! I’m guessing J Money’s before tax earnings of his blog is slightly high 🙂

Four sounds like a great multiple. I think a multiple of 4 would make J. Money a millionaire now after his blog is added in with his other assets.

I would not count that kind of thing in my assets unless I knew I could live without them. What people care about in their wealth calculations is if they can live off their assets or not. This assumes the assets are invested in a specific stock/bond mix, which is not the case of your engagement ring, or your cars.

Those can only be invested if you sell them. If you don’t “need” those assets, then it’s not a problem, but if for example you need a car, then selling yours means you have to buy another one right away, which makes the point void.

This is also why I don’t include my main property in my wealth measure, because if I decide to sell it, then I need to buy another one (or pay for additional rent).

That’s a very interesting way to look at the calculations, and I definitely don’t agree with you….which is why I guess I wrote the blog post, right?

I think that cars, houses, blogs, jewelry, and even stamp collections can and do have a place in your net worth calculation. There’s more to it than if you “can live off their assets or not”.

I agree it’s hard to tell where to draw the line. Expensive jewelry can possibly fetch appraisal values even higher than the retail price. But if times get tough and you have to hock an engagement ring, you’d be shocked how low the resale value is.

That’s a great point, Valerie. I guess an item is only as valuable as what you can get for it, the price others are willing to pay. But, that doesn’t mean that you can’t list the jewelry at a certain value. Maybe you don’t list it at retail price or appraised price. Maybe you list it at a multiple of its value…. 1/2, etc.

If I were to include all those items in my networth, I would include them at the value they would sell for at the time, not what I paid or anything like that. Like Valerie said, an engagement ring might be worth a lot, it doesn’t sell for a lot though.

I tend to exclude them. I recently sold off most of my belongings and downsized significantly. It was an interesting experience. I was realistic about what I owned, many people are not and overvalue those things.

I’m probably the only PF blogger who is obsessed with spreadsheets that doesn’t track net worth. Sure, I’ve calculated it a few times… And then promptly forgot it. But I just don’t think net worth is that useful.