In the past, sending money between family and friends could pose a challenge for many people. You either had to mail a check, complete a wire transfer, or wait to see them in person before delivering cash. Borrowing and lending would take at least a couple days, if not weeks to complete the transaction, assuming no issues arose along the way (e.g., check lost in the mail).

Nowadays, money transfers are more cost-effective, secure and instantaneous than ever. While some payment apps may require you to wait a day or two for transferred funds to reach your bank account, the convenience of digital money transfers arguably outweighs any downsides.

Of course, money transfer apps like Venmo or Google Pay aren’t perfect; there have been multiple reports of Venmo users particularly struggling to get refunded after sending money to the wrong person (a 2019 Planet Money podcast from NPR discussed an incident where someone sent $1,500 to the wrong person and, despite jumping through multiple hoops to get it back from Venmo, they ultimately got their money back only by paying a $30 fee to their bank to cancel the transaction).

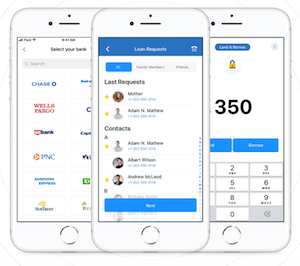

Wouldn’t it be great if there were an easier way to borrow or lend money between family and friends? This is where Zirtue comes in: a relationship-based lending mobile platform that allows users to securely lend and borrow money with friends and family members. Your data is secured by bank-level, 128-bit encryption security and your bank and personal information are never stored in the app, ensuring maximum privacy and information security.

To determine if Zirtue would be a good fit for your borrowing and/or lending needs, let’s explore what Zirtue is all about.

Borrow or Lend Money with Family & Friends

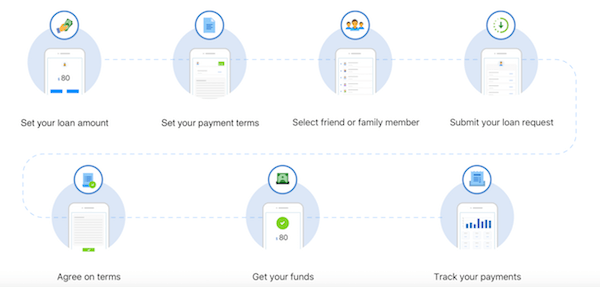

Zirtue relies on ACH bank transfers to set up loans between family members and friends (no debit or credit cards permitted). It is not a lender, but rather a facilitator of lending between people who know each other (as opposed to borrowing from a bank or other financial institution). Zirtue specializes in automating repayment processes by sending borrowers regular reminders to pay off their loans in accordance with their agreed repayment schedule.

With Zirtue, you can borrow as little as $20 or as much as $10,000 with repayment periods lasting between 1 month and 24 months. You can only borrow from someone you know (they’re in your phone contacts) and Zirtue verifies all users’ identities prior to processing and approving financial transactions to ensure everyone involved is protected against fraudulent activity. Since Zirtue is not a crowdfunding platform, all transactions occur on a one-to-one basis.

Once your identities are confirmed and the loan is approved, it may take anywhere from 1-3 business days for the funds to be deposited into your account. The repayment schedule (frequency of payments, amount for each payment) is based on what works best for the borrower and lender, which creates a highly personalized lending experience for both parties.

How Much Does Zirtue Cost?

To maintain its platform, Zirtue charges a one-time service fee of 5% of the total borrowed amount. While other lending and borrowing platforms may have early repayment penalties or other hidden fees, Zirtue charges no other fees besides its 5% service fee.

Additionally, a 5% APR is amortized over the life of the loan and paid directly to the lender on a monthly basis (thereby giving them more of an incentive to lend to you).

Should I Use Zirtue?

Some people say you should never lend or borrow money with friends or family, but that advice ignores the modern realities of online lending practices and digital money management. Rather than relying on a verbal contract or other unverifiable means of establishing a lending and repayment plan between the two parties, Zirtue makes it official with quick, easy and private lending through its highly secure app.

Zirtue is all about simplicity; you won’t have to worry about confusing lending terms, endless pages of borrowing agreements, surprise fees, or the hassle of a credit check. As the borrower, you simply pay the one-time 5% service fee (based on the amount borrowed), set up the transfer and lending agreement with your friend or relative, then receive a deposit within 3 days of the transaction. As the lender, you’ll get the added bonus of 5% APR paid in addition to the full loan amount over the payoff timeframe listed in your agreement.

Hank,

We really appreciate the opportunity to be featured on your Money Q&A Blog.

Thanks for sharing our story and mission of building a more financially inclusive world by digitizing and mobilizing loans between friends and family with automatic ACH loan payments.

Stay Safe & Healthy