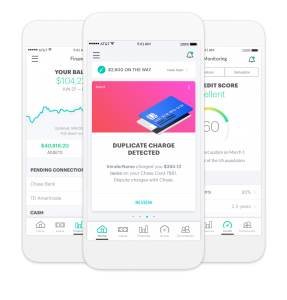

M1 Finance Review – A Great Robo Advisor for Investors

Note – This blog post may contain affiliate links. While all opinions are my own, and I’m a long-time user and proponent of M1 Finance, I do receive a small compensation if you choose to sign up through the links in this article. When it comes to investing with robo-advisors, there are plenty of low-cost, automated trading platforms available today. While there are unique advantages (and disadvantages) to each one, the newest robo-advisor on the market called M1 Finance gives the more established, sophisticated investors great investing options. Developed by a 25 year-old Stanford graduate, M1 Finance simplifies the investment process for beginning and experienced investors alike. Unlike other robo-advisors, M1 Finance does not charge a fee, and it gives … Read more