So, what happens when huge expenses arise out of nowhere? Typically, people either put the expense on their credit cards – and rack up more debt as a result of high interest rates – or take out a personal loan (also with considerably high interest) to cover the emergency costs. This can be a serious setback for anyone trying to improve their financial situation, but at last, a better option exists – MoneyLion.

Founded in 2013, MoneyLion has become immensely popular among consumers due to its easy-to-use app and rewards-based program that incentivizes users to save more money and improve their overall financial health. Since 2013, MoneyLion has helped over 1.5 million consumers work towards their financial goals. MoneyLion has provided more than 200,000 loans and linked to over a million bank accounts to its mobile app.

MoneyLion Review

For anyone who is struggling to stay on top of debt repayments or rebuild their credit score, MoneyLion can help you find better rates and discover simple ways to save more money with minimal effort. Before signing up for MoneyLion, here are a few things you should know about the platform:

What Does MoneyLion Offer?

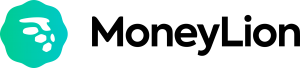

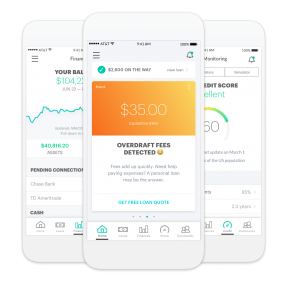

This platform was designed to help consumers take back control over their financial lives by organizing your information in one convenient location on your smart device. Whether you’re trying to build an emergency savings fund, need to find a lower interest rate on personal loans to consolidate your debts, or you simply want to track your spending and credit score, MoneyLion is a one-stop-shop for your personal finance needs.

Automated Savings Program

MoneyLion offers so much more than just easier ways to save. In fact, MoneyLion gives its users access to an automated monthly savings program in which your money will be invested into a carefully managed wealth account. What this means is that you can save a lot of money on interest payments by taking out zero-interest loans to cover your ongoing expenses, repay your debts, and avoid the hundreds of dollars of fees you might otherwise accrue with a traditional personal loan. If you qualify for these fantastic rates, then why would you look anywhere else for loans besides MoneyLion?

Credit Tracking

Monitoring your credit has never been more important, thanks to the recent Equifax hack. Rather than signing up for Equifax’s free credit monitoring program (which caused quite a bit of controversy when the website imposed questionable arbitration clauses in exchange for access to the service), you can find other ways to track your credit report, such as MoneyLion’s credit monitoring software. With this program, you can not only keep tabs on your personal credit records, but you’ll also be able to improve your credit score with the help of other programs MoneyLion offers its customers.

With this program, you can not only keep tabs on your personal credit records. But, you’ll also be able to improve your credit score with the help of other programs MoneyLion offers its customers.

Get Out of a Financial Pinch

This is why MoneyLion is so advantageous for consumers: the platform’s combination of access to low-interest (or interest-free) loans and helpful strategies for saving and tracking your money with minimal effort is designed to make money management as painless as possible. In fact, MoneyLion makes money management fun thanks to its system of rewarding users for sticking to their savings goals.

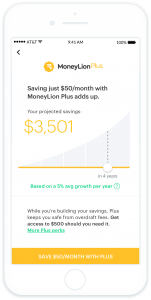

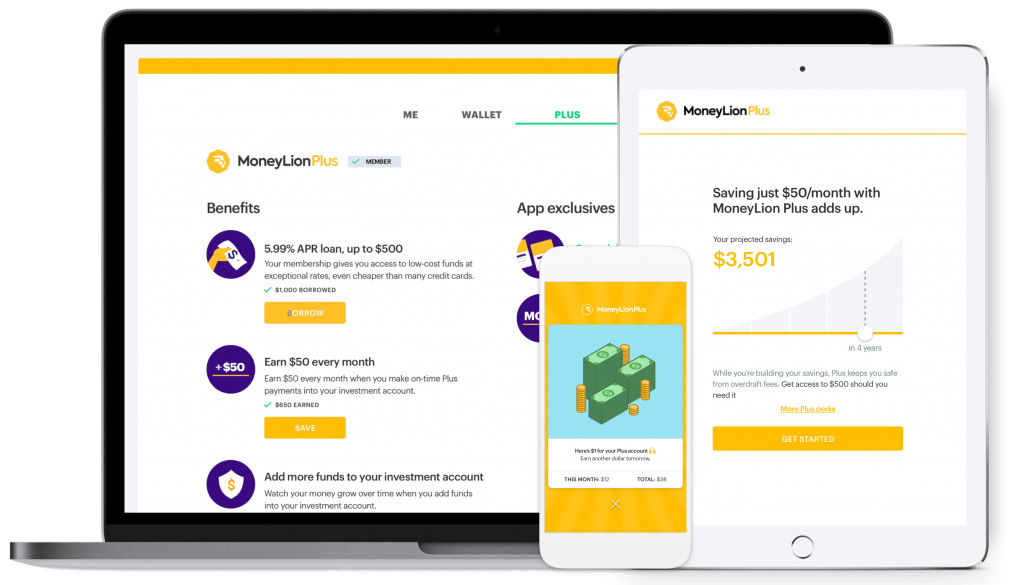

MoneyLion Plus and Grow Your Stack

Investing with MoneyLion is through a fully-managed investment account. The funds saved are automatically invested into a fully-managed investment account featuring a diversified portfolio of ETFs built to suit the financial needs and life stage of each member, all without any additional trading or management fees. These portfolios are based on simple investment strategies that will help members grow their wealth.

Since it’s launch, MoneyLion Plus has propelled first-time investors to over $1 million in savings and members are putting away more than the national savings rate of 2.4%. As America craves better financial literacy and engagement, financial products such as MoneyLion are truly addressing the challenges of the financial middle class, with over 2 million Americans now using MoneyLion to improve their financial well-being.

Cashback bonus

Cashback bonus

MoneyLion Plus offers its members additional rewards, including an instant $1 cashback bonus deposited into a member’s investment account each day they log into the MoneyLion app. Members also earn rewards based on their investment account balance.

MoneyLion Plus is a $29 monthly membership. The program provides members with access to the automated savings program, a MoneyLion wealth account, and access to loans (under 6% APR) if they need them.

The $1 per day cashback bonus rewards component effectively enables the member to more than offset the $29 per month just by logging into the app once a day. This cashback reward will automatically be deposited into the member’s MoneyLion wealth account.

The second component of the rewards program is based on the balance of the member’s wealth account. As the member reaches certain savings milestones, they will receive bonus rewards into their account.

The MoneyLion app evaluates the cash flows and income levels of each member and determines the appropriate amount to automatically deposit into the MoneyLion wealth account each month. So, this is an automated process rather than something a member would have to “deposit” manually.

Should You Try MoneyLion?

MoneyLion is launching its new features to address the financial challenges consumers face today. A Federal Reserve study showed that 46 percent of Americans don’t have $400 saved for an emergency, and two-thirds of Americans were unable to pass a financial literacy test according to another study. MoneyLion’s new features have been designed to help users overcome these challenges by simplifying their day-to-day relationship with money and making it easier to build positive, sustainable financial habits.

Whether you’re a financial superstar or currently stuck in a rut, MoneyLion can help you become more financially resilient with its nifty features and rewarding offers. Instead of keeping track of multiple financial apps, statements, and spending notices on paper or on your phone, you will be able to easily consolidate your finances on one platform and reduce the burden of interest repayments that keep many people from quickly repaying their debts.

- Simple, data-driven advice, wherever you go: From the moment users open the MoneyLion mobile app, they receive personalized recommendations that encourage positive financial behaviors based on their individual spending habits and credit profile. These recommendations are refreshed daily with the user’s latest data to ensure they remain aligned with their current financial situation and objectives.

- Streamlined borrowing experience: MoneyLion’s personal loan process has been streamlined to improve speed, convenience and lower the cost of borrowing. Customers can receive a loan offer in as little as 15 seconds, access funds as quickly as the same business day, and now have even more options for reducing their interest rates.

- New ways to improve credit health: In addition to the free credit score already available to every user, MoneyLion now offers full credit reports from TransUnion® and Equifax, and access to credit counseling and repair options. Customers can also avoid credit surprises with expanded push notifications alerting them to changes to their credit.

“Our mission is to bring our users closer to their financial goals by making money more approachable,” said Diwakar Choubey, CEO and co-founder of MoneyLion. “These new features address the widespread need among consumers for smarter tools that simplify and personalize financial advice, all the while making it easier to build better habits and make good financial decisions more consistently.”

As an added benefit, MoneyLion’s automated savings program ensures you’re able to invest your money into a managed account and grow your funds beyond what a traditional savings account can offer. Ultimately, if you’re looking for an easier way to manage your finances and get out of debt, then you won’t want to miss out on the opportunity to sign up for MoneyLion and have the platform do most of the work for you.

Cashback bonus

Cashback bonus