Buying a second home may seem like an extravagance in today’s cash-strapped economy, but it can potentially become a secondary source of income. With low home prices and interest rates, this may be an ideal time to become a real estate investor.

However, you’ll want to conduct your research carefully and keep the following tips in mind before you invest in real estate and sink your money into a rental or holiday property.

Invest in Real Estate and Rental Property

Look at Different Types of Investments

Before you invest in real estate and make this significant investment, you’ll need to look at all of your options closely. Some investors look for a vacation home that they can rent out on a short-term basis when not using it.

Others prefer to renovate older properties and resell them at a profit, while others will speculate on land that could potentially be developed. If you’re just starting out, it’s usually easiest to purchase a residential house or unit with rental income in mind.

You also need to know that getting a loan for a rental property can be based on the condition. So consider any internal and external renovations you might need to make.

Find the Right Location

Location is extremely important when buying an investment property and you invest in real estate. The more attractive your location, the easier it will be to find tenants. Although rural areas may be picturesque, if there aren’t any amenities nearby you may be faced with long periods of vacancy, during which time you’ll need to pay the mortgage and utilities out of your own pocket.

The best bet is to choose homes in urban areas, near universities, or in resort communities with a steady stream of potential renters. A location near public transportation links, shops, and green spaces will be ideal. Although these desirable locations will lead to higher real estate prices, it also makes the property easier to sell down the road.

Get your Finances in Order (in Advance)

Before you fall in love with a particular piece of real estate NSW along the Gold Coast or a historic Brooklyn brownstone, you’ll want to make sure that you’re looking at properties within your means when you invest in real estate. To begin with, you’ll need to have enough assets or capital to pay for it, along with decent credit.

Investing brings with it additional expenses, and you’ll need to have sufficient backup cash flow to weather periods of vacancy or unexpected repairs due to tenant needs. It’s best to speak to several lenders to compare rates and uncover what your options are.

Consider Enlisting a Third Party

If your finances leave something to be desired or you have little to no experience in the real estate market, it may be best to team up with someone who is in a position to help when you invest in real estate. Many experienced real estate investors welcome partnerships with less experienced investors, working in exchange for the capital that you can provide to the partnership.

In return, you gain the value of a more experienced viewpoint, which can help you find a better deal. You could also work with industry experts like real estate developers, community developers, and real estate entrepreneurs, should they be willing to help. People from each of these professions could become valuable resources because they have knowledge of different aspects of the industry.

These individuals can use this knowledge to ensure that your first rental property experience goes according to plan. Oftentimes, real estate experts will also have relevant education in things like real estate law, real estate finance, and accounting, giving you the opportunity to learn about these aspects of the business along the way. You can make money with your home and real estate.

Use a Property Management Company

Becoming a first-time landlord or an accidental landlord can be challenging, requiring both time and money to ensure that your property is well taken care of. It can be advantageous to shop around for property managers at the same time that you’re looking at properties. They can help with the daily administrative tasks that come as part of the package when you invest in a rental property and keep track of payments and rental income to make life easier when tax season rolls around.

When you invest in a rental property, it can be a great investment. Whether you use a property manager or not, you need to spend a bit of time thinking about these issues to make sure everything goes according to plan.

Investing in Real Estate with Streitwise

Streitwise is a real estate crowdfunding platform for both accredited and non-accredited investors. Anyone who has as little as $5,000 available to invest and a desire to diversify their portfolio beyond stocks and bonds should consider investing in commercial real estate with Streitwise.

Streitwise directly owns and operates its own commercial properties, whereas many other web-based investment platforms serve as middlemen between everyday investors and real estate property managers.

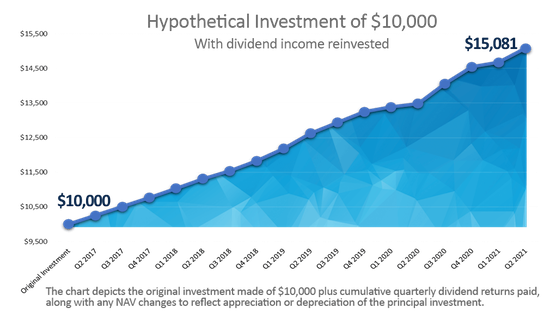

Since its inception, Streitwise has produced almost a 10% dividend for its investors, whereas public REITs produced 3.79% dividends and public bonds produced 2.78% dividend yields. Streitwise just declared their latest dividend payout for Q2 2021, at $0.21/share, or 8.4% annualized dividends. The site has hit its target return range for a 17th straight quarterly distribution with each dividend payout over 8%.

You can also check out my complete review of Streitwise on Money Q&A. If you’ve been wanting to get more active in real estate investing for just a small sum, then a platform like Streitwise might be a great addition to your investment portfolio.

Investing in Real Estate with Roofstock

But, you don’t have to buy homes and rental properties to make a great ROI, there are several different crowdsourced real estate investment options that have a small minimum initial investment such as Roofstock, PeerStreet, and Fundrise. For just a few hundred dollars in many cases, you can now invest in real estate.

Roofstock is the #1 marketplace for buying and selling single-family rental homes. Roofstock has listings in over 40 markets across the US. 1 in 10 homes in the U.S. is single-family rentals (SFR), which equates to over 15 million households.

Single-family rentals are a stable asset class with considerably less volatility than stocks. Single-family rentals prices have remained almost perfectly uncorrelated with stock prices since 1971, with a correlation coefficient of only 0.07.

Their online marketplace empowers everyday investors to own cash-flowing income properties and build wealth through real estate. Roofstock makes it easy to invest remotely. Over 60% of their customers are buying a rental property located more than 1,000 miles away. With their market analysis, Roofstock provides research and data analysis to help you determine which locations meet your investing objectives.

Roofstock’s marketplace offers rental homes for sale in 40 markets and 21 states nationwide, and they are continuing to expand. Roofstock surpassed $1 billion of collective transaction volume within two years of its marketplace launch, making it one of the fastest-growing FinTech startups of all time.

If we were to ever own a rental property, it would likely be somewhere other than where we live, so we would have to use a property management company. The reason I say it would not be near where we live is because prices in the SF Bay Area have never been higher than they are right now. Zillow says our house is worth more today than it ever was in its 55 year history. It’s as if the Great Recession never happened.

These are some great tips for purchasing a rental property. I think it’s wise to make sure you go in knowing if you don’t have a property management company you may be left holding the bag, so to speak, when a problem arises. I’m curious would it be better to get a property management company before you sign the papers, or after?

+1 for property management companies.

While you can save money doing the management yourself, I’d much rather save my time for finding the next investment than for changing locks, fixing toilets, and evicting tenants.