Diversification is one of the most important aspects of investing which includes alternative investments. Without it, you run the risk of losing your original investment, as well as all the value it’s earned.

Diversification spreads the risk of loss across your entire portfolio. This way, if an event such as a market correction occurs, there’s a chance that some of your investments will either hold or increase in value.

The Importance of Diversification

Risk reduction is crucial to building wealth and saving for retirement, but losses can still occur. If your portfolio’s value declines when you are young, you still have time to rebuild. If, however, your portfolio loses value as you approach retirement, you don’t have as much time to recoup your losses.

Key Asset Classes vs. Alternative Investments

When most of us think about investing, we typically think of key asset classes: equities, fixed income assets, and cash. Equities include stocks and shares. Bonds are fixed-income assets. Cash and its equivalents are investments that include commercial paper and U.S. Treasury bills. Many mistakenly believe diversification is simply investing in each of these three classes.

Unfortunately, each of these investment classes tends to move in correlation with one another. This means the value of your portfolio remains at the mercy of forces that broadly move markets. A good example of this effect is the subprime mortgage crisis of 2008-09, each of the key asset classes lost value.

Alternative investment classes move in less correlation with the major markets. These types of investments hedge against inflation and other risks. The following alternative investments diversify your portfolio.

Foreign Currencies

If you want to invest in foreign currency, you have several options. Buying foreign currencies in countries with strong economic growth and relative stability in their regions is becoming an increasingly popular investment. You could, for example, try investing in the Vietnamese dong, or another strong emerging market, such as Iraq, Thailand, Egypt, or Turkey, and simply hold your position until it increases in value.

You could also invest in the Forex market by opening a standard trading account and taking a position on a pair of currencies with a Forex broker. If you choose this avenue, look for a broker with a proven track record that offers transparency.

If you choose to trade on the Forex market, watch out for hidden brokerage fees that can eat into your profits, such as pip spreads and slippage. Forex also offers the opportunity to leverage your initial capital outlay. While leverage is great if your trading position increases in value, you can lose many times more than your original investment if your bet doesn’t pan out.

Buying a Certificate of Deposit (CD) that earns interest based on one or more foreign currencies is another way to invest in foreign currencies. You could also buy shares of a mutual fund that invests in bonds issued by foreign governments or invest in stocks of multinational corporations with significant business operations in foreign countries.

Precious Metals

Precious metals such as gold, silver, and platinum, are attractive alternative investments because they tend to increase in value during times of economic uncertainty and high inflation. While they are highly liquid, meaning they can be used as currency outright or can be quickly converted into cash, they also don’t earn income or dividends, you make money on precious metals by buying when the price is low and selling when it increases in value.

The most popular way to buy precious metals is directly from a dealer, and are often sold as coins and bars. They are also used in jewelry and objects of art. Exchange traded funds (ETF) that invest in gold bullion and other metals are another popular way to invest, as is buying stocks of mining companies or buying mutual funds invested in multiple mining companies.

Precious metals can help to balance your portfolio but are directly affected by changes in the price of gold and other metals which are highly volatile. The mining of precious metals is an extremely speculative business facing increased regulation due to growing environmental concerns.

Private Equity

Private equity firms pool money from individual investors and institutions and then invest this capital to purchase assets such as companies and real estate. Investors receive proceeds once the firm liquidates its position, usually via direct sale or an initial public offering (IPO).

Investing in private equity normally requires a large initial deposit of funds, often upwards of $250,000, and positions are held long-term, often 10 years or more. Once the position is closed, investors usually receive returns with a rate of growth much higher than that offered by traditional public markets, making this an ideal portfolio hedge for high net worth investors.

Investing in Real Estate with Roofstock

But, you don’t have to buy homes and rental properties to make a great ROI, there are several different crowdsourced real estate investment options that have a small minimum initial investment such as Roofstock, PeerStreet, Streitwise, and Fundrise. For just a few hundred dollars in many cases, you can now invest in real estate.

Roofstock is the #1 marketplace for buying and selling single-family rental homes. Roofstock has listings in over 40 markets across the US. 1 in 10 homes in the U.S. are single-family rentals (SFR), which equates to over 15 million households.

Single-family rentals are a stable asset class with considerably less volatility than stocks. Single-family rentals prices have remained almost perfectly uncorrelated with stock prices since 1971, with a correlation coefficient of only 0.07.

Their online marketplace empowers everyday investors to own cash-flowing income properties and build wealth through real estate. Roofstock makes it easy to invest remotely. Over 60% of their customers are buying a rental property located more than 1,000 miles away. With their market analysis, Roofstock provides research and data analysis to help you determine which locations meet your investing objectives.

Roofstock’s marketplace offers rental homes for sale in 40 markets and 21 states nationwide, and they are continuing to expand. Roofstock surpassed $1 billion of collective transaction volume within two years of its marketplace launch, making it one of the fastest-growing FinTech startups of all time.

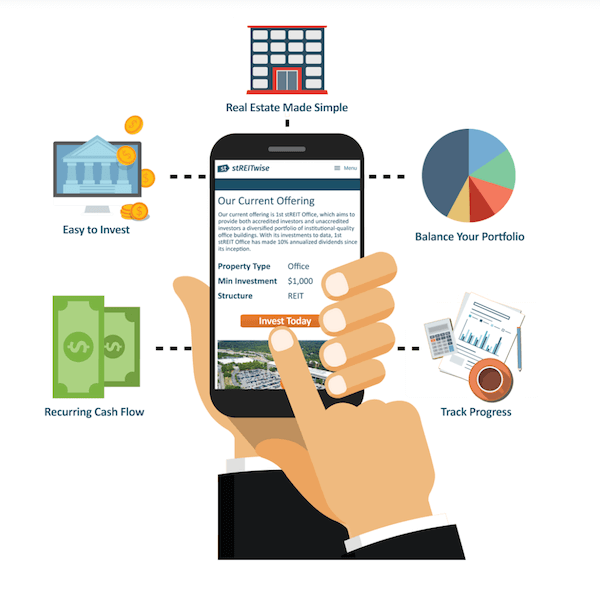

Passive Income with Streitwise

Streitwise presents an excellent opportunity for investors to create passive income streams with commercial real estate investments. Dividends are disbursed to shareholders on a quarterly basis (typically averaging 8-9% on an annual basis), which means you could have a check arriving in the mail or money depositing into your bank account every 3 months while the value of the properties you invest in continues to grow.

Streitwise also offers a dividend reinvestment program to significantly accumulate more wealth for investors who opt-in. DRIPs are beneficial for investors who prefer to maximize their long-term returns instead of using dividends as a source of passive income, so it’s up to you to decide what you want to do with your Streitwise dividends.